- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-02-2018

(raw materials / closing price /% change)

Oil 62.37 +1.33%

Gold 1,348.90 -0.54%

(index / closing price / change items /% change)

Nikkei +428.96 22149.21 +1.97%

TOPIX +37.78 1775.15 +2.17%

Euro Stoxx 50 -19.01 3407.79 -0.55%

FTSE 100 -47.04 7247.66 -0.64 %

DAX -66.36 12385.60 -0.53%

CAC 40 -25.40 5256.18 -0.48%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2406 -0,81%

GBP/USD $1,3996 -0,74%

USD/CHF Chf0,92883 +0,75%

USD/JPY Y106,58 +0,42%

EUR/JPY Y132,23 -0,39%

GBP/JPY Y149,172 -0,32%

AUD/USD $0,7911 -0,43%

NZD/USD $0,7370 -0,50%

USD/CAD C$1,25607 +0,64%

0:00 China Bank holiday

00:30 Australia RBA Meeting's Minutes

07:00 Germany Producer Price Index (MoM) January 0.2% 0.3%

07:00 Germany Producer Price Index (YoY) January 2.3% 1.9%

07:00 Switzerland Trade Balance January 2.632 2.78

10:00 Eurozone ZEW Economic Sentiment February 31.8 28.4

10:00 Germany ZEW Survey - Economic Sentiment February 20.4 16.0

11:00 United Kingdom CBI industrial order books balance February 14 10

13:30 Canada Wholesale Sales, m/m December 0.7% 0.4%

15:00 Eurozone Consumer Confidence (Preliminary) February 1.3 1.0

EURUSD: 1.2200 (EUR 1.2bln)

AUDUSD: 0.7920 (AUD 210m) 0.8000 (550m)

NZDUSD: 0.7200 (NZD 300m)

EUR/USD

Offers 1.2435 1.2450 1.2465 1.2480 1.2500 1.2520 1.2535 1.2550

Bids 1.2395-00 1.2380-855 1.2350 1.2330 1.2300 1.2285 1.2250

USD/JPY

Offers 106.65 106.80 107.00 107.30 107.50 107.85 108.00

Bids 106.20 106.00 105.80-85 105.65 105.50 105.00

GBP/USD

Offers 1.4035 1.4050 1.4065 1.4080 1.4100 1.4120 1.4135 1.4150

Bids 1.3980-85 1.3965 1.3950 1.3935 1.3920 1.3900 1.3880 1.3850

AUD/USD

Offers 0.7935 0.7950 0.7980-85 0.8000 0.8030 0.8050

Bids 0.7900 0.7880 0.7865 0.7850 0.7830 0.7800

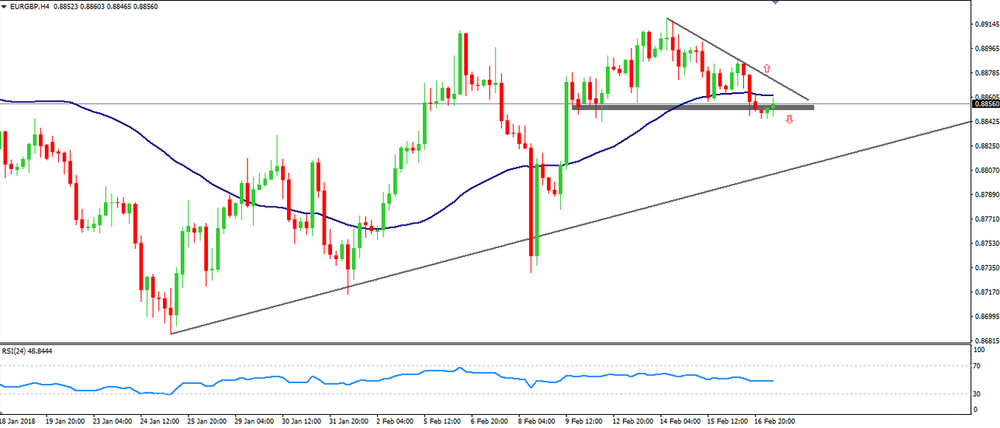

EUR/GBP

Offers 0.8865 0.8885 0.8900 0.8920 0.8930 0.8950

Bids 0.8845-50 0.8830 0.8820 0.8800 0.8785 0.8750

EUR/JPY

Offers 132.50 132.80 133.00 133.30 133.50 134.00

Bids 132.00 131.80 131.65 131.50 131.30 131.00

-

Says the series of speeches by ministers shows the government is setting out what it wants to achieve from its future partnership with the EU

-

OECD commercial oil stocks rose in jan 2018 and were about 74 mln barrels over latest 5-year average

-

OPEC and non-OPEC producers' technical meeting will take place in june

EUR/GBP on 4-hour time frame chart might be interesting to follow this pair.

In this scenario, we can both consider long or short entries.

Once the price breaks the downside trend line we can expect a new bullish trend.

However, if the price breaks the support level below, then, we can expect a further bearish movement close to the upside trend.

This reflected surpluses for goods (€30.9 billion), services (€7.3 billion) and primary income (€3.7 billion), which were partly offset by a deficit for secondary income (€12.0 billion).

According to the preliminary results for 2017 as a whole, the current account recorded a surplus of €391.4 billion (3.5% of euro area GDP), compared with one of €367.6 billion (3.4% of euro area GDP) in 2016. This development was due to increases in the surpluses for services (from €39.0 billion to €80.9 billion) and primary income (from €95.3 billion to €112.8 billion). These were partly offset by a decrease in the surplus for goods (from €373.0 billion to €348.2 billion) and an increase in the deficit for secondary income (from €139.7 billion to €150.5 billion).

Japan had a merchandise trade deficit of 943.417 billion yen in January, the Ministry of Finance said on Monday, cited by rttnews.

That exceeded forecasts for a shortfall of 1,003.6 billion yen following the 358.7 billion yen deficit in December.

Exports advanced an annual 12.2 percent, topping expectations for 9.4 percent and up from 9.3 percent in the previous month.

Imports climbed 7.9 percent on year versus forecasts for 7.7 percent and down from 14.9 percent a month earlier.

-

Greece government to continue to issue market debt and use proceeds to smooth further maturity profile

-

Greece's deposit growth to continue, although return of deposits will continue to be hampered by high fiscal burden

European stocks finished Friday's session in rally mode, posting their biggest weekly win in more than a year alongside on ongoing recovery in equities on Wall Street. The Stoxx Europe 600 index SXXP, +1.09% leapt 1.1% to close at 380.62, its third straight gain. All sectors rose, led by telecom and health care shares. On Thursday, the index rose 0.5%.

The U.S. stock market on Friday posted one of its best weekly performances in years, recapturing half of the losses from the startling market correction earlier this month and discovering a new "wall of worry" to climb. The S&P 500 SPX, +0.04% closed nearly flat at 2,732. 22 on Friday and booked a 4.3% weekly gain, and is now only 5% below the all-time peak set in January. Dow industrials DJIA, +0.08% also halved its peak-to-trough losses, while both indexes are up about 2% year to date.

Asian shares started Monday higher as confidence in equities continued to return, with some markets in the region reopening after the Lunar New Year holiday. South Korea's Kospi SEU, +0.87% was up 1.2%, Singapore's benchmark STI, +1.06% gained 0.5% and Japan's Nikkei Stock Average NIK, +1.97% rose 1.1%, helped by some yen softening after last week's sharp rises. Shares in Australia XJO, +0.64% also rose while stocks in New Zealand NZ50GR, -0.12% underperformed.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2555 (3727)

$1.2512 (2116)

$1.2484 (2664)

Price at time of writing this review: $1.2409

Support levels (open interest**, contracts):

$1.2358 (1131)

$1.2335 (2858)

$1.2308 (6241)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 9 is 129052 contracts (according to data from February, 16) with the maximum number of contracts with strike price $1,2400 (6241);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4182 (2388)

$1.4158 (1921)

$1.4119 (3712)

Price at time of writing this review: $1.4017

Support levels (open interest**, contracts):

$1.3947 (620)

$1.3905 (1300)

$1.3850 (799)

Comments:

- Overall open interest on the CALL options with the expiration date March, 9 is 48082 contracts, with the maximum number of contracts with strike price $1,3900 (3712);

- Overall open interest on the PUT options with the expiration date March, 9 is 44869 contracts, with the maximum number of contracts with strike price $1,3900 (2352);

- The ratio of PUT/CALL was 0.93 versus 0.94 from the previous trading day according to data from February, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Oil 62.28 +1.19%

Gold 1,352.70 -0.26%

(index / closing price / change items /% change)

NIKKEI 21720.25 +255.27 +1.19%

ASX 200 5904.00 -5.00 -0.08%

NZ50 8125.31 +61.98 +0.77%

Euro Stoxx 50 +37.17 3426.80 +1.10%

FTSE 100 +59.89 7294.70 +0.83%

DAX +105.79 12451.96 +0.86%

CAC 40 +59.06 5281.58 +1.13%

DJIA +19.01 25219.38 +0.08%

S&P 500 +1.02 2732.22 +0.04%

NASDAQ -16.96 7239.47 -0.23%

S&P/TSX +44.98 15452.64 +0.29%

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,2506 +0,80%

GBP/USD $1,4099 +0,61%

USD/CHF Chf0,92187 -0,62%

USD/JPY Y106,14 -0,17%

EUR/JPY Y132,75 +0,64%

GBP/JPY Y149,647 +0,44%

AUD/USD $0,7945 +0,48%

NZD/USD $0,7407 +0,24%

USD/CAD C$1,24803 -0,58%

00:00 China Bank holiday

00:00 U.S. Bank holiday

09:00 Eurozone Current account, unadjusted, bln December 37.8

10:00 Eurozone Construction Output, y/y December 2.7%

11:00 Germany Bundesbank Monthly Report

18:45 United Kingdom BOE Gov Mark Carney Speaks

21:45 New Zealand PPI Input (QoQ) Quarter IV 1.0% 0.3%

21:45 New Zealand PPI Output (QoQ) Quarter IV 1.0% 0.4%

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.