- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-09-2018

| Raw materials | Closing price | % change |

| Oil | $69.80 | 1.29% |

| Gold | $1,203.40 | -0.20% |

| Index | Change items | Closing price | % change |

| Nikkei | +325.87 | 23420.54 | +1.41% |

| TOPIX | +31.27 | 1759.88 | +1.81% |

| Hang Seng | +151.81 | 27084.66 | +0.56% |

| CSI 300 | +64.51 | 3269.43 | +2.01% |

| KOSPI | +5.97 | 2308.98 | +0.26% |

| FTSE 100 | -1.87 | 7300.23 | -0.03% |

| DAX | +61.26 | 12157.67 | +0.51% |

| CAC 40 | +14.92 | 5363.79 | +0.28% |

| DJIA | +184.84 | 26246.96 | +0.71% |

| S&P 500 | +15.51 | 2904.31 | +0.54% |

| NASDAQ | +60.31 | 7956.11 | +0.76% |

| Pare | Closed | % change |

| EUR/USD | $1,1670 | -0,12% |

| GBP/USD | $1,3147 | -0,06% |

| USD/CHF | Chf0,96393 | +0,16% |

| USD/JPY | Y112,36 | +0,47% |

| EUR/JPY | Y131,13 | +0,34% |

| GBP/JPY | Y147,726 | +0,41% |

| AUD/USD | $0,7222 | +0,62% |

| NZD/USD | $0,6587 | +0,02% |

| USD/CAD | C$1,29774 | -0,43% |

Major US stock indices grew moderately against the backdrop of a rise in the price of technological and consumer sectors, as investors estimated the latest exchange of tariffs in the trade war with China as less destructive than previously feared.

Yesterday, US President Donald Trump announced the introduction of additional tariffs on goods imported from China worth a total of $ 200 billion. The amount of fees will be 10%, which will come into force on September 24. The new amount of duties will be in effect until the end of the year, and from the beginning of 2019 they will be increased to 25%. Trump also threatened to extend protectionist measures if China took retaliatory measures. In this case, the president promised to immediately begin the third stage, providing for additional duties on imports of $ 267 billion. However, the important point was that from the list of Chinese products, to which the US introduced new duties, excluded about 300 goods, in particular smart -clock. Against this background, shares of Apple (AAPL) moderately increased. Earlier, the company expressed concern that the "wide range" of its products could suffer from tariffs.

In addition, as it became known, the confidence of builders in the market of newly built houses for one family remained unchanged in September, at the level of 67 points. "Despite the growing problems with accessibility, builders continue to report strong demand for housing, especially when thousands of townspeople and other beginners enter the market," said NAHB chairman Randy Noel.

Most DOW components recorded a rise (24 out of 30). Leader of the growth were shares of NIKE, Inc. (NKE, + 2.44%). Outsider shares were DowDuPont Inc. (DWDP, -1.12%).

Almost all sectors of S & P completed the auction in positive territory. The commodities sector grew most (+ 1.2%). The decrease was shown only by the sector of conglomerates (-0.5%)

At closing:

Dow 26,246.96 +184.84 +0.71%

S & P 500 2,904.31 +15.51 +0.54%

Nasdaq 100 7,956.11 +60.31 +0.76%

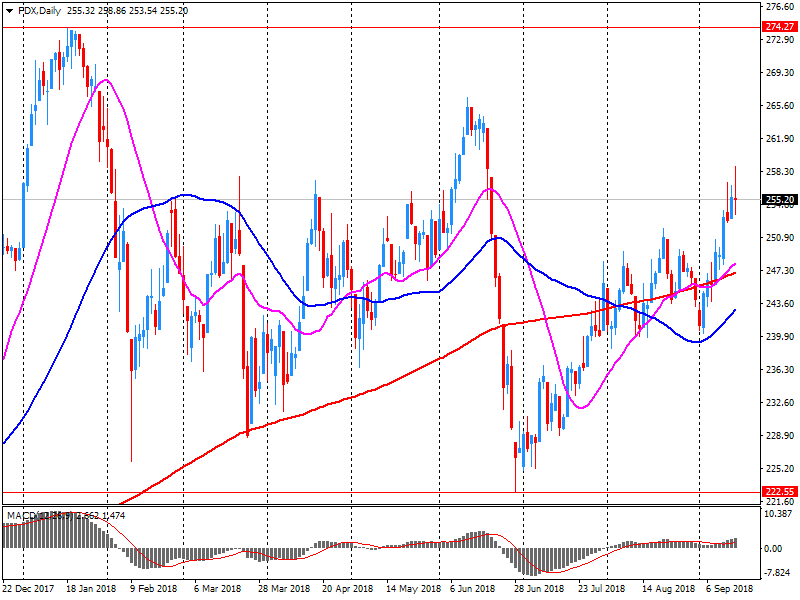

EUR/USD has been on a downtrend since April and there aren't many reasons why it should stop, says Meera Chandan, a forex strategist at J.P. Morgan. "There is no compelling reason to think that the trend in EUR/USD will reverse," she says, adding that "risks are biased towards the continuation of the trend." Market participants have priced in fewer Federal Reserve interest rate rises over the next 12 to 18 months, Ms. Chandan notes. J.P. Morgan expects the two-year U.S. yield to reach 3.05% by the end of this year. On Tuesday, the yield is at around 2.8%. EUR/USD is last up by 0.2% to 1.1705 - via WSJ

Builder confidence in the market for newly-built single-family homes remained unchanged at a solid 67 reading in September on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

"Despite rising affordability concerns, builders continue to report firm demand for housing, especially as millennials and other newcomers enter the market," said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. "The recent decline in lumber prices from record-high levels earlier this summer is also welcome relief, although builders still need to manage construction costs to keep homes competitively priced.

U.S. stock-index futures rose slightly on Tuesday, helped by an increase in oil prices and concessions that made the latest round of the U.S. tariffs on Chinese goods less hurting than initially expected.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 23,420.54 | +325.87 | +1.41% |

| Hang Seng | 27,084.66 | +151.81 | +0.56% |

| Shanghai | 2,699.95 | +48.16 | +1.82% |

| S&P/ASX | 6,161.50 | -23.50 | -0.38% |

| FTSE | 7,304.44 | +2.34 | +0.03% |

| CAC | 5,362.53 | +13.66 | +0.26% |

| DAX | 12,117.09 | +20.68 | +0.17% |

| Crude | $69.60 | | +1.00% |

| Gold | $1,205.60 | | -0.02% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 43.2 | 0.37(0.86%) | 2819 |

| ALTRIA GROUP INC. | MO | 62.46 | 0.02(0.03%) | 220 |

| Amazon.com Inc., NASDAQ | AMZN | 1,925.50 | 17.47(0.92%) | 59687 |

| Apple Inc. | AAPL | 218.94 | 1.06(0.49%) | 267958 |

| AT&T Inc | T | 33.59 | -0.03(-0.09%) | 7015 |

| Barrick Gold Corporation, NYSE | ABX | 10.4 | 0.05(0.48%) | 13187 |

| Boeing Co | BA | 357.32 | 1.36(0.38%) | 6058 |

| Caterpillar Inc | CAT | 147.2 | 0.98(0.67%) | 6919 |

| Chevron Corp | CVX | 118 | 0.49(0.42%) | 1368 |

| Cisco Systems Inc | CSCO | 47.22 | 0.11(0.23%) | 1996 |

| Citigroup Inc., NYSE | C | 71.19 | 0.31(0.44%) | 4855 |

| Exxon Mobil Corp | XOM | 83.8 | 0.39(0.47%) | 5904 |

| Facebook, Inc. | FB | 159.5 | -1.08(-0.67%) | 222691 |

| FedEx Corporation, NYSE | FDX | 249 | -6.73(-2.63%) | 10825 |

| Ford Motor Co. | F | 9.5 | -0.05(-0.52%) | 31559 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14 | 0.28(2.04%) | 65412 |

| General Electric Co | GE | 12.64 | -0.06(-0.47%) | 60091 |

| General Motors Company, NYSE | GM | 35 | -0.02(-0.06%) | 8972 |

| Goldman Sachs | GS | 228.69 | 0.80(0.35%) | 1723 |

| Google Inc. | GOOG | 1,158.90 | 2.85(0.25%) | 2793 |

| Hewlett-Packard Co. | HPQ | 25.1 | 0.09(0.36%) | 150 |

| Home Depot Inc | HD | 209 | 0.60(0.29%) | 1719 |

| HONEYWELL INTERNATIONAL INC. | HON | 164.13 | -1.62(-0.98%) | 301 |

| Intel Corp | INTC | 45.62 | 0.20(0.44%) | 10792 |

| International Business Machines Co... | IBM | 148 | 0.06(0.04%) | 1146 |

| JPMorgan Chase and Co | JPM | 114.22 | 0.38(0.33%) | 17946 |

| Merck & Co Inc | MRK | 70.45 | 0.03(0.04%) | 745 |

| Microsoft Corp | MSFT | 112.58 | 0.44(0.39%) | 51864 |

| Nike | NKE | 83.75 | 0.49(0.59%) | 4091 |

| Pfizer Inc | PFE | 42.95 | -0.06(-0.14%) | 600 |

| Starbucks Corporation, NASDAQ | SBUX | 54.45 | -0.12(-0.22%) | 3243 |

| Tesla Motors, Inc., NASDAQ | TSLA | 297.2 | 2.36(0.80%) | 29837 |

| The Coca-Cola Co | KO | 46.48 | 0.16(0.35%) | 2427 |

| Twitter, Inc., NYSE | TWTR | 28.8 | -0.06(-0.21%) | 66444 |

| United Technologies Corp | UTX | 136.94 | -0.82(-0.60%) | 453 |

| Visa | V | 146.55 | 0.37(0.25%) | 2231 |

| Wal-Mart Stores Inc | WMT | 95.45 | 0.63(0.66%) | 3915 |

| Yandex N.V., NASDAQ | YNDX | 31.59 | 0.50(1.61%) | 7127 |

Higher sales in the transportation equipment and chemical industries drove the increase.

Overall, sales were up in 11 of 21 industries, representing 68% of total manufacturing sales. Non-durable goods rose 1.4% to $27.7 billion, while durable goods increased 0.5% to $30.9 billion.

Constant dollar sales increased 1.0%, indicating that a higher volume of goods was sold in July.

The gain in the transportation equipment industry accounted for more than half of the total increase in Canadian manufacturing sales in July. Sales in the industry were up 2.6% to $10.9 billion, mostly as a result of gains in the motor vehicle and the railroad rolling stock industries. In July, scheduled shutdowns for some assembly plants were shorter than in previous years. Sales in the motor vehicle assembly industry rose 3.0% to $5.4 billion, a second consecutive monthly increase. Sales in the railroad rolling stock industry were up 63.4% to $275 million, following a 30.4% decline in June. Sales in this industry tend to be volatile compared with transportation equipment as a whole.

NIKE (NKE) target raised to $92 from $87 at Telsey Advisory Group

-

The 30-year bond yield was up 0.6 basis point to 3.143%, close to a more than a three-month high

FedEx (FDX) reported Q1 FY 2019 earnings of $3.46 per share (versus $2.65 in Q1 FY 2018), missing analysts' consensus estimate of $3.83.

The company's quarterly revenues amounted to $17.052 bln (+11.5% y/y), generally in-line with analysts' consensus estimate of $16.879 bln.

The company also raised its FY2019 EPS guidance to $17.20-17.80 from a prior guidance of $17.00-17.60 (versus analysts' consensus estimate of $17.39) and reaffirmed FY2019 revenue guidance at +9% y/y to ~$71.34 bln (versus analysts' consensus estimate of $70.94 bln).

FDX fell to $250.79 (-1.93%) in pre-market trading.

House prices in Australia were down 0.7 percent on quarter in the second quarter of 2018, according to rttnews - in line with expectations and unchanged from the three months prior.

The capital city residential property price indexes fell in Sydney (-1.2 percent), Melbourne (-0.8 percent), Perth (-0.1 percent) and Darwin (-0.9 percent), and rose in Brisbane (+0.7 percent), Hobart (+3.0 percent), Adelaide (+0.3 percent) and Canberra (+0.6 percent).

On a yearly basis, house prices dipped 0.6 percent versus expectations for a loss of 0.7 percent after rising 2.0 percent in Q1.

Annually, residential property prices fell in Darwin (-6.1 percent), Sydney (-3.9 percent) and Perth (-0.9 percent), and rose in Hobart (+15.5 percent), Canberra (+3.0 percent), Melbourne (+2.3 percent), Adelaide (+2.1 percent) and Brisbane (+1.7 percent).

-

Tariffs of 10% on Chinese Goods Take Effect Sept. 24, Will Rise to 25% at the End of the Year

-

China Has Said It Will Retaliate With New Tariffs On U.S. Goods

-

New Tariffs Follow Trump Duties Imposed On $50 Billion in Chinese Imports Earlier in Summer

EUR/USD

Resistance levels (open interest**, contracts)

$1.1830 (3185)

$1.1811 (3624)

$1.1776 (607)

Price at time of writing this review: $1.1701

Support levels (open interest**, contracts):

$1.1657 (1780)

$1.1621 (3759)

$1.1581 (5924)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 15 is 90633 contracts (according to data from September, 17) with the maximum number of contracts with strike price $1,1600 (5924);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3288 (2198)

$1.3256 (2228)

$1.3230 (720)

Price at time of writing this review: $1.3150

Support levels (open interest**, contracts):

$1.3104 (1040)

$1.3043 (646)

$1.3007 (1020)

Comments:

- Overall open interest on the CALL options with the expiration date October, 15 is 27111 contracts, with the maximum number of contracts with strike price $1,3200 (2902);

- Overall open interest on the PUT options with the expiration date October, 15 is 30447 contracts, with the maximum number of contracts with strike price $1,2800 (2461);

- The ratio of PUT/CALL was 1.12 versus 1.12 from the previous trading day according to data from September, 17.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.