- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-05-2018

-

Says there must be guarantees for Ukraine of continued gas transit

-

Question of Syria reconstruction needs to be depoliticised

-

We are pleased Sergei Skripal out of hospital

-

If it had been weapons grade agent, Skripal would be dead

U.S. stock-index futures fell on Friday amid caution over developments in the U.S.-China trade talks.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,930.36 | +91.99 | +0.40% |

| Hang Seng | 31,047.91 | +105.76 | +0.34% |

| Shanghai | 3,193.05 | +38.76 | +1.23% |

| S&P/ASX | 6,087.40 | -6.90 | -0.11% |

| FTSE | 7,762.32 | -25.65 | -0.33% |

| CAC | 5,616.74 | -5.18 | -0.09% |

| DAX | 13,079.81 | -34.80 | -0.27% |

| Crude | $71.40 | | -0.13% |

| Gold | $1,285.70 | | -0.29% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 50.99 | 0.28(0.55%) | 701 |

| Amazon.com Inc., NASDAQ | AMZN | 1,578.00 | -3.76(-0.24%) | 29727 |

| Apple Inc. | AAPL | 186.67 | -0.32(-0.17%) | 101566 |

| AT&T Inc | T | 31.99 | 0.06(0.19%) | 13781 |

| Barrick Gold Corporation, NYSE | ABX | 13.13 | -0.06(-0.45%) | 895 |

| Boeing Co | BA | 345.5 | 1.36(0.40%) | 14177 |

| Caterpillar Inc | CAT | 154.15 | 0.46(0.30%) | 2151 |

| Chevron Corp | CVX | 129.45 | -0.01(-0.01%) | 419 |

| Cisco Systems Inc | CSCO | 43.3 | -0.16(-0.37%) | 29086 |

| Citigroup Inc., NYSE | C | 71.29 | -0.27(-0.38%) | 28277 |

| Deere & Company, NYSE | DE | 147 | 0.19(0.13%) | 186196 |

| Exxon Mobil Corp | XOM | 81.9 | 0.02(0.02%) | 11943 |

| Facebook, Inc. | FB | 183 | -0.76(-0.41%) | 53345 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.58 | -0.20(-1.19%) | 6200 |

| General Electric Co | GE | 15.02 | -0.01(-0.07%) | 203723 |

| Goldman Sachs | GS | 239.41 | 0.31(0.13%) | 403 |

| Google Inc. | GOOG | 1,061.29 | -17.30(-1.60%) | 23355 |

| Home Depot Inc | HD | 185.21 | -0.12(-0.06%) | 3643 |

| HONEYWELL INTERNATIONAL INC. | HON | 147.95 | 0.83(0.56%) | 520 |

| Intel Corp | INTC | 54.48 | -0.33(-0.60%) | 20446 |

| International Business Machines Co... | IBM | 144.9 | 0.40(0.28%) | 1406 |

| Johnson & Johnson | JNJ | 124.2 | 0.35(0.28%) | 9121 |

| JPMorgan Chase and Co | JPM | 112.91 | -0.05(-0.04%) | 5742 |

| McDonald's Corp | MCD | 162 | 0.69(0.43%) | 1271 |

| Merck & Co Inc | MRK | 58.8 | -0.27(-0.46%) | 1264 |

| Microsoft Corp | MSFT | 95.88 | -0.30(-0.31%) | 22599 |

| Nike | NKE | 70.93 | -0.01(-0.01%) | 3567 |

| Pfizer Inc | PFE | 35.56 | -0.15(-0.42%) | 1112 |

| Procter & Gamble Co | PG | 73.94 | -0.02(-0.03%) | 2768 |

| Starbucks Corporation, NASDAQ | SBUX | 57.17 | -0.03(-0.05%) | 2912 |

| Tesla Motors, Inc., NASDAQ | TSLA | 284.4 | -0.14(-0.05%) | 12134 |

| The Coca-Cola Co | KO | 42.27 | -0.03(-0.07%) | 4499 |

| Twitter, Inc., NYSE | TWTR | 32.53 | -0.05(-0.15%) | 28574 |

| United Technologies Corp | UTX | 124.11 | -0.50(-0.40%) | 288 |

| Verizon Communications Inc | VZ | 47.95 | 0.10(0.21%) | 574 |

| Visa | V | 129.84 | -0.09(-0.07%) | 3814 |

| Wal-Mart Stores Inc | WMT | 84.25 | -0.24(-0.28%) | 32711 |

| Walt Disney Co | DIS | 104.8 | 0.46(0.44%) | 2502 |

Wal-Mart (WMT) reiterated with an Overweight at Stephens

Wal-Mart (WMT) reiterated with a Hold at Stifel

Wal-Mart (WMT) reiterated with an Outperform at Telsey

Visa (V) initiated with a Neutral at UBS

Intel (INTC) initiated with a Market Perform at Cowen

The Consumer Price Index (CPI) rose 2.2% on a year-over-year basis in April, following a 2.3% increase in March.

Seven of eight major components increased on a year-over-year basis in April. The recreation, education and reading index (-0.2%) was the lone major component to decline year over year.

The price of services (+2.3%) increased more slowly on a year-over-year basis in April, after posting a 2.7% increase in March. This was largely a result of price decreases in travel services, which declined 6.0% year over year. A smaller year-over-year increase in the cost of air transportation (+11.9%) coincided with the price decrease in travel services.

Higher sales at motor vehicle and parts dealers more than offset lower sales at food and beverage stores and gasoline stations.

Sales were up in 6 of 11 subsectors, representing 53% of retail trade. Excluding sales at motor vehicle and parts dealers, retail sales were down 0.2% in March.

After removing the effects of price changes, retail sales in volume terms increased 0.8%.

Following a 2.0% increase in sales in February, motor vehicle and parts dealers (+3.0%) were again the largest contributor in dollar terms to the increase in March. New car dealers (+3.3%) accounted for the majority of the gain, although all store types in this subsector reported increases.

Clothing and clothing accessories stores (+2.5%) posted higher sales in March, following a decrease in February. For the first time since November 2017, sales increased at all store types in this subsector.

Receipts at general merchandise stores (+1.0%) rose for the fifth time in six months.

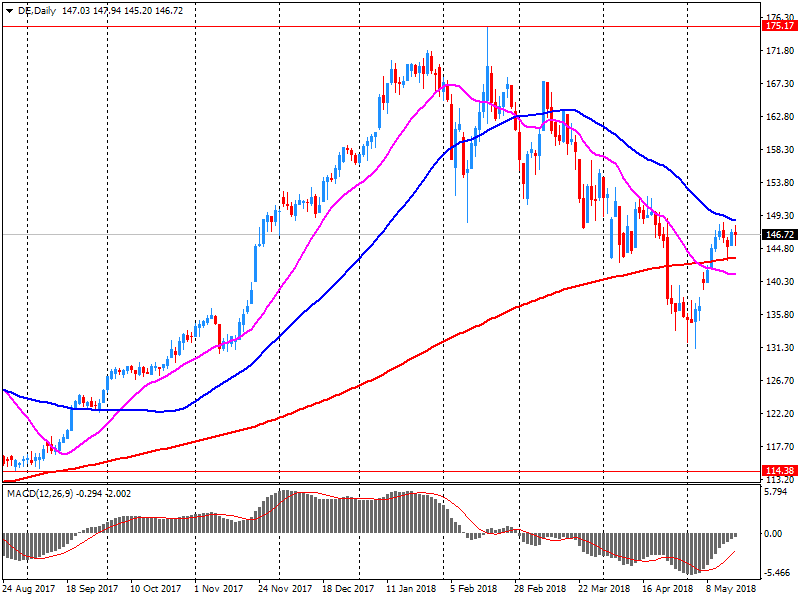

Deere (DE) reported Q2 FY 2018 earnings of $3.14 per share (versus $2.14 in Q2 FY 2017), missing analysts' consensus estimate of $3.33.

The company's quarterly revenues amounted to $9.747 bln (+34.3% y/y), generally in-line with analysts' consensus estimate of $9.828 bln.

The company issued upside guidance for Q3, projecting Q3 equipment sales of ~$9.2 bln (+35% y/y) versus analysts' consensus estimate of $8.84 bln. It also raised guidance for FY 2018, projecting FY18 equipment sales of ~$33.65 bln (+30% y/y) versus analysts' consensus estimate of $33.55 bln.

DE fell to $146.50 (-0.21%) in pre-market trading.

This reflected surpluses for goods (€30.2 billion), services (€9.4 billion) and primary income (€3.9 billion), which were partly offset by a deficit for secondary income (€11.5 billion).

The 12-month cumulated current account for the period ending in March 2018 recorded a surplus of €407.7 billion (3.6% of euro area GDP), compared with €375.2 billion (3.5% of euro area GDP) in the 12 months to March 2017. This development was mainly due to an increase in the surplus for services (from €41.7 billion to €103.5 billion) and, to a lesser extent, in the surplus for goods (from €355.1 billion to €358.2 billion), which were partially offset by decreases in the surpluses for primary income (from €116.8 billion to €91.0 billion) and an increase in the deficit for secondary income (from €138.4 billion to €144.9 billion).

The first estimate for euro area (EA19) exports of goods to the rest of the world in March 2018 was €199.9 billion, a decrease of 2.9% compared with March 2017 where they peaked at €205.9 bn. Imports from the rest of the world stood at €173.0 bn, a fall of 2.5% compared with March 2017 (€177.4 bn). As a result, the euro area recorded a €26.9 bn surplus in trade in goods with the rest of the world in March 2018, compared with +€28.5 bn in March 2017. Intra-euro area trade fell to €170.5 bn in March 2018, down by 0.6% compared with March 2017.

In January to March 2018, euro area exports of goods to the rest of the world rose to €555.7 bn (an increase of 2.5% compared with January-March 2017), while imports rose to €506.3 bn (an increase of 1.4% compared with January-March 2017). As a result the euro area recorded a surplus of €49.4 bn, compared with +€42.9 bn in January-March 2017. Intra-euro area trade rose to €485.6 bn in January-March 2018, up by 4.1% compared with January-March 2017.

-

Says U.S. economy near Fed's policy goals, most favorable outlook 'seen in a long time'

-

Rate hikes a possible defense against financial stability risks

Overall nationwide consumer prices in Japan were up just 0.6 percent on year in April, say rttnews.

That was shy of expectations for a gain of 0.7 percent and was down sharply from 1.1 percent in March.

Core CPI was up 0.7 percent on year, beneath forecasts for 0.8 percent and down from 0.9 percent in the previous month.

On a monthly basis, overall CPI was down 0.4 percent and core CPI eased 0.1 percent.

As reported by the Federal Statistical Office, the selling prices in wholesale trade increased by 1.4% in April 2018 from the corresponding month of the preceding year. In March 2018 and in February 2018 the annual rates of change were +1.2%, each.

From March 2018 to April 2018 the index rose by 0.5%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1946 (1865)

$1.1917 (1119)

$1.1873 (298)

Price at time of writing this review: $1.1808

Support levels (open interest**, contracts):

$1.1756 (3012)

$1.1730 (2802)

$1.1699 (3283)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 8 is 154575 contracts (according to data from May, 17) with the maximum number of contracts with strike price $1,1400 (7135);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3663 (2710)

$1.3634 (870)

$1.3609 (935)

Price at time of writing this review: $1.3511

Support levels (open interest**, contracts):

$1.3461 (738)

$1.3415 (2407)

$1.3352 (2491)

Comments:

- Overall open interest on the CALL options with the expiration date June, 8 is 38785 contracts, with the maximum number of contracts with strike price $1,3600 (2710);

- Overall open interest on the PUT options with the expiration date June, 8 is 40493 contracts, with the maximum number of contracts with strike price $1,3400 (2491);

- The ratio of PUT/CALL was 1.04 versus 1.06 from the previous trading day according to data from May, 17.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

In April 2018 the index of producer prices for industrial products rose by 2.0% compared with the corresponding month of the preceding year. In March the annual rate of change all over had been 1.9%, as reported by the Federal Statistical Office.

Compared with the preceding month March the overall index rose by 0.5% in April 2018 (+0.1% in March 2018 and -0.1% in February 2018).

In April 2018 the price indices of all main industrial groups increased compared with April 2017: Energy prices were up 3.2%, though the development of prices of the different energy carriers diverged. Prices of electricity increased by 6.1%, whereas prices of petroleum products were up 3.3% and prices of natural gas (distribution) rose by 0.4%. Prices of intermediate goods were up 2.1%. Prices of non-durable consumer goods rose by 1.1% and of durable consumer goods by 1.5%, whereas prices of capital goods increased by 1.2%.

The overall index disregarding energy was 1.6% up on April 2017 and 0.2% compared

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.