- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-01-2018

(raw materials / closing price /% change)

Oil 63.88 -0.65%

Gold 1,338.80 +0.29%

(index / closing price / change items /% change)

Nikkei +236.93 23951.81 +1.00%

TOPIX +10.35 1894.25 +0.55%

Hang Seng +565.88 31904.75 +1.81%

CSI 300 +33.23 4258.47 +0.79%

Euro Stoxx 50 +10.20 3622.01 +0.28%

FTSE 100 -13.21 7755.93 -0.17%

DAX +45.82 13246.33 +0.35%

CAC 40 +4.13 5513.82 +0.07%

DJIA -10.33 25792.86 -0.04%

S&P 500 -9.82 2776.42 -0.35%

NASDAQ -37.37 7223.69 -0.51%

S&P/TSX -72.93 16298.88 -0.45%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,2260 -0,04%

GBP/USD $1,3790 -0,03%

USD/CHF Chf0,95941 -0,35%

USD/JPY Y110,46 -0,05%

EUR/JPY Y135,43 -0,08%

GBP/JPY Y152,336 -0,08%

AUD/USD $0,7960 -0,04%

NZD/USD $0,7265 -0,44%

USD/CAD C$1,24343 +0,05%

0:30 Australia Home Loans November -0.6% -0.2%

10:00 Eurozone Construction Output, y/y November 2.0%

10:00 Eurozone Harmonized CPI December 0.1% 0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December 0.9% 0.9%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December 1.5% 1.4%

11:45 United Kingdom MPC Member Saunders Speaks

14:15 U.S. Capacity Utilization December 77.1% 77.3%

14:15 U.S. Industrial Production YoY December 3.4%

14:15 U.S. Industrial Production (MoM) December 0.2% 0.4%

15:00 Canada Bank of Canada Monetary Policy Report

15:00 Canada Bank of Canada Rate 1% 1.25%

15:00 Canada BOC Rate Statement

15:00 U.S. NAHB Housing Market Index January 74 72

16:15 Canada BOC Press Conference

19:00 U.S. Fed's Beige Book

20:00 U.S. FOMC Member Charles Evans Speaks

20:15 U.S. FOMC Member Kaplan Speak

21:00 U.S. Net Long-term TIC Flows November 23.2

21:00 U.S. Total Net TIC Flows November 151.2

21:30 U.S. FOMC Member Mester Speaks

The main US stock indexes fell slightly, departing from the next record highs, which was due to the fall in shares of the commodity sector against the backdrop of lower oil prices. Investors also focused on reports from UnitedHealth (UNH) and Citigroup (C).

In addition, the results of research published by the Federal Reserve Bank of New York showed that the region's production index fell in January, while the average forecasts of economists assumed that the index will remain at the same level. According to the data, the production index in the current month fell to +17.7 points compared to +18 points in December. Previous value was not revised. Recall, the index is built on the basis of survey results of top managers. The indicator reflects the situation in the production orders segment and business optimism in the business environment.

Most components of the DOW index recorded a decline (16 out of 30). Outsider were shares of General Electric Company (GE, -3.44%). Leader of the growth were shares of Merck & Co., Inc. (MRK, + 6.12%).

Most S & P sectors ended the session in negative territory. The largest decrease was in the commodity sector (-1.2%). The conglomerate sector grew most (+ 0.4%).

At closing:

DJIA -0.04% 25.792.86 -10.33

Nasdaq -0.51% 7,224.00 -37.00

S & P -0.35% 2,776.44 -9.80

U.S. stock-index futures rose on Tuesday, as investors digested fourth-quarter earnings from UnitedHealth (UNH) and Citigroup (C).

Global Stocks:

Nikkei 23,951.81 +236.93 +1.00%

Hang Seng 31,904.75 +565.88 +1.81%

Shanghai 3,437.48 +27.00 +0.79%

S&P/ASX 6,048.60 -28.50 -0.47%

FTSE 7,755.17 -13.97 -0.18%

CAC 5,522.62 +12.93 +0.23%

DAX 13,316.85 +116.34 +0.88%

Crude $64.02 (-0.44%)

Gold $1,334.20 (-0.05%)

-

The eurozone still needs an accommodative monetary policy, but can gradually reduce intensity of monetary policy support

-

He is confident ECB can manage a smooth exit from ultra-loose monetary policy

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 245.91 | 1.44(0.59%) | 2715 |

| ALCOA INC. | AA | 56.3 | -0.46(-0.81%) | 11900 |

| ALTRIA GROUP INC. | MO | 69.95 | 0.34(0.49%) | 6534 |

| Amazon.com Inc., NASDAQ | AMZN | 1,322.87 | 17.67(1.35%) | 67932 |

| American Express Co | AXP | 101.9 | 0.93(0.92%) | 1172 |

| Apple Inc. | AAPL | 178.39 | 1.30(0.73%) | 185136 |

| AT&T Inc | T | 37.1 | 0.20(0.54%) | 18852 |

| Barrick Gold Corporation, NYSE | ABX | 15.29 | 0.17(1.12%) | 234552 |

| Boeing Co | BA | 340.1 | 3.89(1.16%) | 50612 |

| Caterpillar Inc | CAT | 171.75 | 1.45(0.85%) | 11949 |

| Chevron Corp | CVX | 133.86 | 0.26(0.19%) | 3872 |

| Cisco Systems Inc | CSCO | 41.18 | 0.31(0.76%) | 17330 |

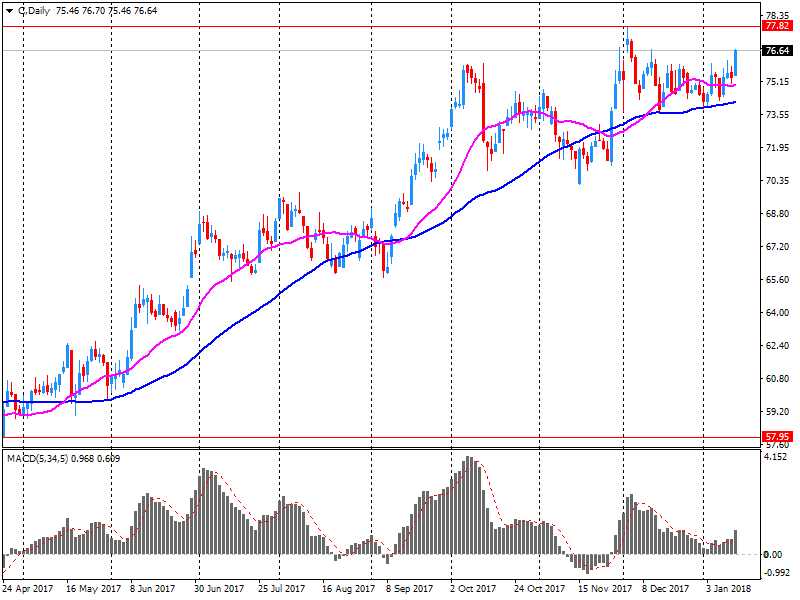

| Citigroup Inc., NYSE | C | 78.83 | 1.99(2.59%) | 701047 |

| Deere & Company, NYSE | DE | 170.55 | 1.25(0.74%) | 1512 |

| Exxon Mobil Corp | XOM | 87.8 | 0.28(0.32%) | 8085 |

| Facebook, Inc. | FB | 181.29 | 1.92(1.07%) | 502978 |

| FedEx Corporation, NYSE | FDX | 274 | 2.15(0.79%) | 1327 |

| Ford Motor Co. | F | 13.37 | 0.14(1.06%) | 98148 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.65 | -0.10(-0.51%) | 19200 |

| General Electric Co | GE | 18.25 | -0.51(-2.72%) | 4641529 |

| General Motors Company, NYSE | GM | 45.51 | 1.44(3.27%) | 209190 |

| Goldman Sachs | GS | 259.79 | 2.76(1.07%) | 10330 |

| Google Inc. | GOOG | 1,131.80 | 9.54(0.85%) | 10179 |

| Hewlett-Packard Co. | HPQ | 22.97 | 0.05(0.22%) | 5603 |

| Home Depot Inc | HD | 197.76 | 1.34(0.68%) | 4533 |

| HONEYWELL INTERNATIONAL INC. | HON | 159 | -0.07(-0.04%) | 2641 |

| Intel Corp | INTC | 43.5 | 0.26(0.60%) | 36954 |

| International Business Machines Co... | IBM | 165.55 | 2.41(1.48%) | 41153 |

| Johnson & Johnson | JNJ | 146.84 | 1.08(0.74%) | 2401 |

| JPMorgan Chase and Co | JPM | 112.74 | 0.07(0.06%) | 115009 |

| McDonald's Corp | MCD | 174 | 0.43(0.25%) | 3730 |

| Merck & Co Inc | MRK | 61.8 | 3.14(5.35%) | 1387871 |

| Microsoft Corp | MSFT | 90.2 | 0.60(0.67%) | 44472 |

| Nike | NKE | 64.86 | 0.19(0.29%) | 2455 |

| Pfizer Inc | PFE | 36.7 | 0.16(0.44%) | 2858 |

| Procter & Gamble Co | PG | 90.64 | 1.03(1.15%) | 22023 |

| Starbucks Corporation, NASDAQ | SBUX | 60.5 | 0.10(0.17%) | 1594 |

| Tesla Motors, Inc., NASDAQ | TSLA | 337.91 | 1.69(0.50%) | 19420 |

| The Coca-Cola Co | KO | 46.29 | 0.14(0.30%) | 6070 |

| Travelers Companies Inc | TRV | 135.4 | 0.67(0.50%) | 337 |

| Twitter, Inc., NYSE | TWTR | 25.8 | 0.39(1.53%) | 166136 |

| United Technologies Corp | UTX | 138.2 | 1.62(1.19%) | 1294 |

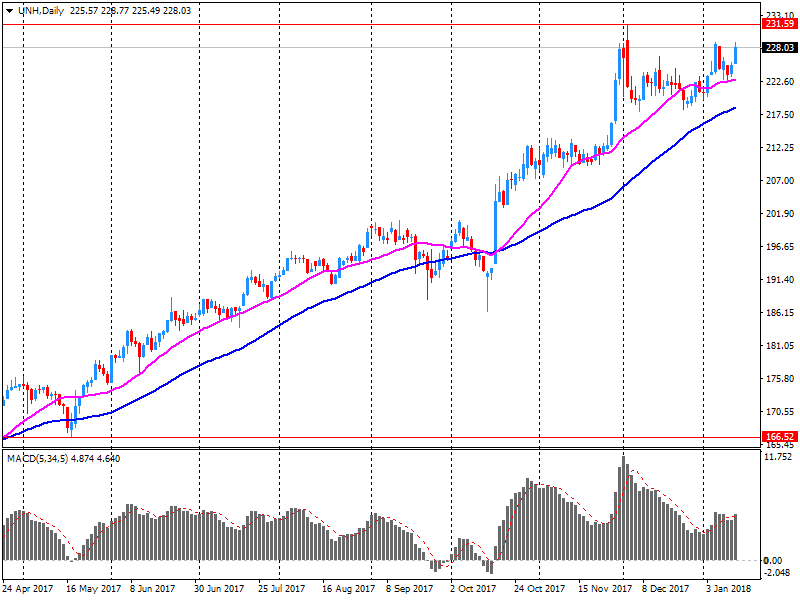

| UnitedHealth Group Inc | UNH | 230.8 | 2.16(0.94%) | 93243 |

| Verizon Communications Inc | VZ | 51.78 | -0.08(-0.15%) | 9785 |

| Visa | V | 121.65 | 1.56(1.30%) | 7682 |

| Wal-Mart Stores Inc | WMT | 101.42 | 0.55(0.55%) | 8570 |

| Walt Disney Co | DIS | 112.99 | 0.52(0.46%) | 5855 |

| Yandex N.V., NASDAQ | YNDX | 35.23 | 0.63(1.82%) | 40358 |

Boeing (BA) target raised to $415 from $320 at Cowen

Verizon (VZ) downgraded to Neutral from Buy at MoffettNathanson

Procter & Gamble (PG) upgraded to Neutral from Sell at Goldman

Business activity continued to grow at a solid clip in New York State, according to firms responding to the January 2018 Empire State Manufacturing Survey.

The headline general business conditions index, at 17.7, was little changed from last month's level. The new orders index and the shipments index both showed ongoing growth, although at a slower pace than in December. Unfilled orders and delivery times increased slightly, and inventory levels were higher.

Labor market conditions pointed to a modest increase in employment and steady workweeks. Both input prices and selling prices increased at a faster pace than last month. Firms remained very optimistic about future business conditions and capital spending plans were robust.

Citigroup (C) reported Q4 FY 2017 earnings of $1.28 per share (versus $1.14 in Q4 FY 2016), beating analysts' consensus estimate of $1.19.

The company's quarterly revenues amounted to $17.255 bln (+1.4% y/y), generally in-line with analysts' consensus estimate of $17.230 bln.

C rose to $78.35 (+1.97%) in pre-market trading.

-

Wants swift procedure to form a new government to avert political uncertainty and harm the economy

-

Nominates defence minister Mihai Fifor as interim PM

UnitedHealth (UNH) reported Q4 FY 2017 earnings of $2.44 per share (versus $2.11 in Q4 FY 2016), missing analysts' consensus estimate of $2.52.

The company's quarterly revenues amounted to $52.061 bln (+9.5% y/y), generally in-line with analysts' consensus estimate of $51.570 bln.

The company also issued guidance for FY 2018, projecting EPS of $12.30-12.60, including tax benefits, compared to its previous EPS forecast of $10.55-10.85 and versus analysts' consensus estimate of $11.20.

UNH rose to $234.78 (+2.69%) in pre-market trading.

USD/JPY on the last week fell + 200 pips.

The price since the beginning of this week continues to show signs of a possible continuation of a bearish movement.

If we look at 1 hour time frame chart we can see that the price is forming a upside trend which can be interesting for an entry once the price breaks that trend.

January 16

Before the Open:

Citigroup (C). Consensus EPS $1.19, Consensus Revenues $17229.88 mln.

UnitedHealth (UNH). Consensus EPS $2.52, Consensus Revenues $51570.43 mln.

January 17

Before the Open:

Bank of America (BAC). Consensus EPS $0.45, Consensus Revenues $21605.10 mln.

Goldman Sachs (GS). Consensus EPS $4.95, Consensus Revenues $7638.28 mln.

After the Close:

Alcoa (AA). Consensus EPS $1.25, Consensus Revenues $3318.11 mln.

January 18

Before the Open:

Morgan Stanley (MS). Consensus EPS $0.78, Consensus Revenues $9248.93 mln.

After the Close:

American Express (AXP). Consensus EPS $1.54, Consensus Revenues $8729.79 mln.

IBM (IBM). Consensus EPS $5.14, Consensus Revenues $22048.59 mln.

UK house prices grew by 5.1% in the year to November 2017, experiencing a 0.3 percentage point decrease from the previous month.

The Royal Institution of Chartered Surveyors' (RICS) UK Residential Market Survey for November 2017 (PDF, 598KB) reported that their headline near term price expectations series rose to -5% from -10% in October, meaning three month expectations are now more or less flat at the national level. Similarly, the new buyer enquiries series stabilised with a net balance of -5% of respondents noting a decline in demand (as opposed to an increase), up from -19% in October.

The headline rate of inflation for goods leaving the factory gate (output prices) rose 3.3% on the year to December 2017, up from 3.1% in November 2017.

Prices for materials and fuels (input prices) rose 4.9% on the year to December 2017, down from 7.3% in November 2017.

All industries provided upward contributions to output annual inflation; the largest contribution was made by food products.

Prices of imported materials and fuels increased 4.5% on the year to December 2017, down from 6.7% in November 2017.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) 12-month inflation rate was 2.7% in December 2017, down from 2.8% in November 2017.

Following a steady increase from late 2015, since April 2017 the CPIH rate has levelled off, ranging between 2.6% and 2.8%.

The downward effect came mainly from air fares, along with a fall in the prices of a range of recreational goods, particularly games and toys.

The downward contributions were partially offset by an increase in tobacco prices, reflecting duty increases that came into effect following the Autumn Budget, along with an increase in petrol and diesel prices.

The Consumer Prices Index (CPI) 12-month rate was 3.0% in December 2017, down from 3.1% in November 2017.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2370 (2966)

$1.2339 (3431)

$1.2313 (4085)

Price at time of writing this review: $1.2228

Support levels (open interest**, contracts):

$1.2139 (352)

$1.2087 (1716)

$1.2054 (2055)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 94394 contracts (according to data from January, 12) with the maximum number of contracts with strike price $1,2100 (5552);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3889 (1793)

$1.3863 (3071)

$1.3841 (3190)

Price at time of writing this review: $1.3780

Support levels (open interest**, contracts):

$1.3651 (84)

$1.3623 (201)

$1.3591 (659)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 30167 contracts, with the maximum number of contracts with strike price $1,3600 (3490);

- Overall open interest on the PUT options with the expiration date February, 9 is 26584 contracts, with the maximum number of contracts with strike price $1,3500 (3246);

- The ratio of PUT/CALL was 0.88 versus 0.92 from the previous trading day according to data from January, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

In 2017 the average index of selling prices in wholesale trade was 3.5% higher than the average index of 2016, as reported by the Federal Statistical Office (Destatis).

Compared with December 2016, the index increased by 1.8% in December 2017. In November 2017 the annual rate of change was +3.3% and in October 2017 it was +3.0%, respectively.

Compared with November 2017 the index of wholesale prices fell by 0.3% in December 2017

Consumer prices in Germany rose by 1.8% on an annual average in 2017 compared with 2016. The increase was above the relevant levels of the past four years. Between 2014 and 2016, the year-on-year-rates of price increase were even below one percent each. The Federal Statistical Office (Destatis) also reports that the inflation rates as measured by the consumer price index ranged between +1.5% and +2.2% in the individual months of 2017. In December 2017, the inflation rate stood at +1.7%.

The marked increase in the year-on-year rate of price increase in 2017 was mainly due to energy prices. Compared with 2016, energy prices increased by 3.1% in 2017 after they had declined in the previous three years (2016: -5.4%; 2015: -7.0%; 2014: -2.1%). Regarding energy products, especially the prices of heating oil (+16.0%) and motor fuels (+6.0%) were up in 2017 year on year. Declining prices were however recorded for gas (-2.8%) and charges for central and district heating (-1.5%).

European stocks finished lower Monday, weighed as the euro continued to march up further into three-year highs, giving a key regional benchmark its third drop in four sessions. Investors were also watching for developments from the U.K., where construction and outsourcing heavyweight Carillion PLC has collapsed.

U.S. equities and bond markets are closed Monday for the Martin Luther King Jr. Day holiday.

Asian equities' best start to a year since 2006 continued Tuesday as most bourses in the region pushed higher. The yen declined amid concern Japanese authorities may want to limit gains that pushed the currency to a four-month high.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.