- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-11-2018

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 10:00 | Eurozone | Harmonized CPI | October | 0.5% | 0.2% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | October | 0.9% | 1.1% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | October | 2.1% | 2.2% |

| 13:30 | Canada | Foreign Securities Purchases | September | 2.82 | |

| 13:30 | Canada | Manufacturing Shipments (MoM) | September | -0.4% | 0.3% |

| 14:15 | U.S. | Capacity Utilization | October | 78.1% | 78.2% |

| 14:15 | U.S. | Industrial Production (MoM) | October | 0.3% | 0.2% |

| 14:15 | U.S. | Industrial Production YoY | October | 5.1% | |

| 18:00 | U.S. | Baker Hughes Oil Rig Count | November | 886 | |

| 21:00 | U.S. | Total Net TIC Flows | September | 108.2 | |

| 21:00 | U.S. | Net Long-term TIC Flows | September | 131.8 |

Major US stock indexes have risen significantly, helped by the rally in the technology sector and the base materials sector, as well as favorable data on US retail sales.

The Commerce Department reported that retail sales rose 0.8% in October, after declining by 0.1% in September, as households bought electronics and household appliances. Economists had forecast a growth rate of 0.5%. On an annualized basis, retail sales grew by 4.6% after rising 4.2% earlier. With the exception of cars, gasoline, building materials and food, retail sales rose 0.3% last month. These so-called major retail sales most closely correspond to the consumer spending component of GDP. The retail sales report says that consumer spending retained most of its strong momentum at the beginning of the fourth quarter, probably keeping the economy on the path of strong growth, despite the trade deficit and the housing market, which is expected to worsen.

In addition, the focus was on statements by Fed Chairman Powell, who gave a positive assessment of the US economy, which can be regarded as the Fed's intention to continue raising interest rates next month. “The US economy is in good shape,” Powell said, adding that the last employment report for October was “very strong.”

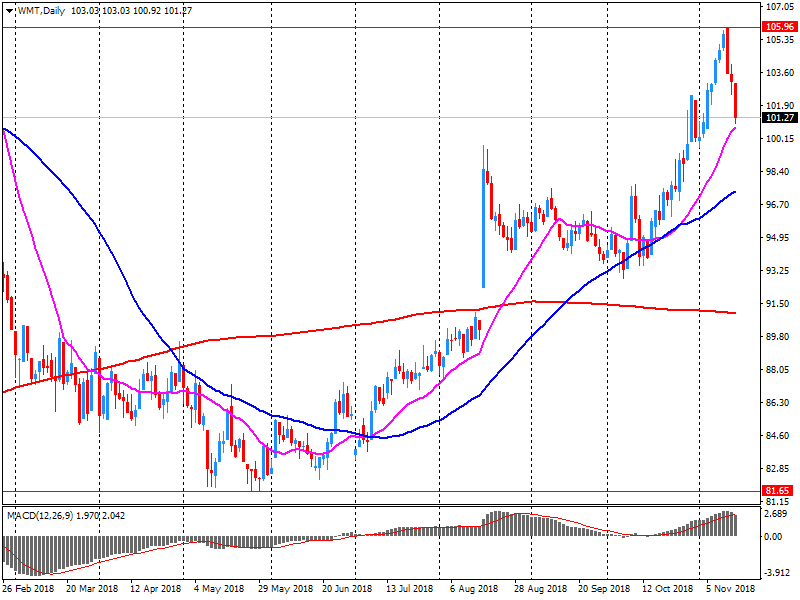

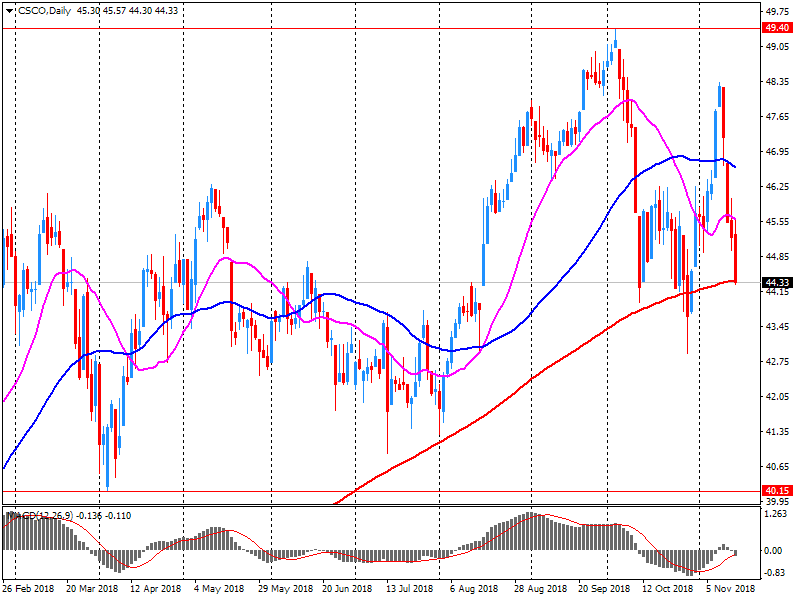

Most of the components of DOW finished trading in positive territory (20 of 30). The leader of growth were shares of Cisco Systems, Inc. (CSCO + 5.46%). Walmart Inc. shares turned out to be an outsider. (WMT, -2.20%).

Most sectors of the S & P showed an increase. The technological sector grew the most (+ 1.8%). The largest decline recorded sector conglomerates (-1.0%)

At the time of closing:

Dow 25,289.27 +208.77 +0.83%

S & P 500 2,730.20 +28.62 +.06%

Nasdaq 100 7,259.03 +122.64 +1.72%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 10:00 | Eurozone | Harmonized CPI | October | 0.5% | 0.2% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | October | 0.9% | 1.1% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | October | 2.1% | 2.2% |

| 13:30 | Canada | Foreign Securities Purchases | September | 2.82 | |

| 13:30 | Canada | Manufacturing Shipments (MoM) | September | -0.4% | 0.3% |

| 14:15 | U.S. | Capacity Utilization | October | 78.1% | 78.2% |

| 14:15 | U.S. | Industrial Production (MoM) | October | 0.3% | 0.2% |

| 14:15 | U.S. | Industrial Production YoY | October | 5.1% | |

| 18:00 | U.S. | Baker Hughes Oil Rig Count | November | 886 | |

| 21:00 | U.S. | Total Net TIC Flows | September | 108.2 | |

| 21:00 | U.S. | Net Long-term TIC Flows | September | 131.8 |

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 10.3 million barrels from the previous week. At 442.1 million barrels, U.S. crude oil inventories are about 5% above the five year average for this time of year.

Total motor gasoline inventories decreased by 1.4 million barrels last week and are about 7% above the five year average for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week.

Distillate fuel inventories decreased by 3.6 million barrels last week and are about 8% below the five year average for this time of year. Propane/propylene inventories decreased by 0.8 million barrels last week and are at the five year average for this time of year. Total commercial petroleum inventories decreased last week by 1.4 million barrels last week.

U.S. stock-index futures traded flat on Wednesday, as declines in technology sector, led by Amazon (AMZN) and Facebook (FB), offset upbeat earnings reports from Walmart Inc (WMT) and Cisco Systems Inc (CSCO), as well as better-than-expected retail sales data.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,803.62 | -42.86 | -0.20% |

Hang Seng | 26,103.34 | +448.91 | +1.75% |

Shanghai | 2,668.17 | +35.93 | +1.36% |

S&P/ASX | 5,736.00 | +3.20 | +0.06% |

FTSE | 7,038.41 | +4.62 | +0.07% |

CAC | 5,041.90 | -26.95 | -0.53% |

DAX | 1,405.79 | -6.74 | -0.06% |

Crude | $56.46 | +0.37% | |

Gold | $1,212.00 | +0.16% |

“Hiring slowed significantly this month,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Despite steep declines in trade, natural resources and mining, and leisure and hospitality, we did see some solid growth in education and healthcare, manufacturing and professional services.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 201.2 | 3.14(1.59%) | 1499 |

ALTRIA GROUP INC. | MO | 59.11 | 0.01(0.02%) | 2133 |

Amazon.com Inc., NASDAQ | AMZN | 1,590.14 | -8.87(-0.55%) | 89659 |

Apple Inc. | AAPL | 187.94 | 1.14(0.61%) | 404467 |

AT&T Inc | T | 30.54 | 0.03(0.10%) | 18800 |

Barrick Gold Corporation, NYSE | ABX | 12.83 | 0.12(0.94%) | 24040 |

Boeing Co | BA | 342 | -2.72(-0.79%) | 6816 |

Caterpillar Inc | CAT | 125.36 | 0.26(0.21%) | 3921 |

Chevron Corp | CVX | 114.44 | -0.16(-0.14%) | 1616 |

Cisco Systems Inc | CSCO | 46.12 | 1.79(4.04%) | 235586 |

Citigroup Inc., NYSE | C | 63.16 | -0.34(-0.54%) | 72155 |

Deere & Company, NYSE | DE | 145.42 | -1.80(-1.22%) | 3401 |

Exxon Mobil Corp | XOM | 77.3 | -0.09(-0.12%) | 4147 |

Facebook, Inc. | FB | 141.5 | -2.72(-1.89%) | 167881 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.6 | 0.06(0.52%) | 31114 |

General Electric Co | GE | 8.28 | -0.04(-0.48%) | 209339 |

General Motors Company, NYSE | GM | 35.08 | -0.15(-0.43%) | 4020 |

Goldman Sachs | GS | 202.5 | 0.01(0.00%) | 8767 |

Hewlett-Packard Co. | HPQ | 23.75 | 0.02(0.08%) | 560 |

Home Depot Inc | HD | 180 | 0.10(0.06%) | 13028 |

Intel Corp | INTC | 47.11 | 0.02(0.04%) | 21750 |

International Business Machines Co... | IBM | 120.39 | 0.19(0.16%) | 2015 |

Johnson & Johnson | JNJ | 144.16 | -0.09(-0.06%) | 556 |

JPMorgan Chase and Co | JPM | 108.25 | 0.92(0.86%) | 73457 |

McDonald's Corp | MCD | 183.55 | -0.30(-0.16%) | 294 |

Microsoft Corp | MSFT | 104.88 | -0.09(-0.09%) | 35506 |

Pfizer Inc | PFE | 42.78 | -0.13(-0.30%) | 1808 |

Procter & Gamble Co | PG | 93.1 | -0.39(-0.42%) | 2320 |

Starbucks Corporation, NASDAQ | SBUX | 66.83 | -0.21(-0.31%) | 590 |

Tesla Motors, Inc., NASDAQ | TSLA | 344.25 | 0.25(0.07%) | 34844 |

The Coca-Cola Co | KO | 49.73 | -0.03(-0.06%) | 534 |

Travelers Companies Inc | TRV | 123.41 | 0.37(0.30%) | 1281 |

Twitter, Inc., NYSE | TWTR | 32.9 | -0.01(-0.03%) | 41850 |

UnitedHealth Group Inc | UNH | 264.48 | -0.48(-0.18%) | 1140 |

Verizon Communications Inc | VZ | 58.91 | -0.03(-0.05%) | 6121 |

Visa | V | 139.4 | 0.16(0.11%) | 3962 |

Wal-Mart Stores Inc | WMT | 102.4 | 0.87(0.86%) | 586369 |

Walt Disney Co | DIS | 116.95 | -0.17(-0.15%) | 1826 |

Yandex N.V., NASDAQ | YNDX | 29.18 | 0.27(0.93%) | 2194 |

Business activity continued to grow at a solid clip in New York State, according to firms responding to the November 2018 Empire State Manufacturing Survey. The headline general business conditions index edged up two points to 23.3. New orders and shipments increased moderately, while unfilled orders held steady. Delivery times continued to lengthen somewhat, and inventories moved higher. Labor market indicators pointed to an increase in employment levels and longer workweeks. The prices paid index remained elevated, and the prices received index was little changed. Looking ahead, firms remained fairly optimistic about the six-month outlook.

Prices for U.S. imports increased 0.5 percent in October, the U.S. Bureau of Labor Statistics reported today, after advancing 0.2 percent in September. Higher fuel and nonfuel prices contributed to the October increase. U.S. export prices advanced 0.4 percent in October after recording no change in September.

The price index for import fuels increased 3.3 percent in October, after advancing 0.7 percent in September; the rise was the largest monthly advance since a 6.1-percent increase in May. Higher prices for both petroleum and natural gas contributed to the advance in October.

In the week ending November 10, the advance figure for seasonally adjusted initial claims was 216,000, an increase of 2,000 from the previous week's unrevised level of 214,000. The 4-week moving average was 215,250, an increase of 1,500 from the previous week's unrevised average of 213,750. The advance seasonally adjusted insured unemployment rate was 1.2 percent for the week ending November 3, an increase of 0.1 percentage point from the previous week's unrevised rate

Advance estimates of U.S. retail and food services sales for October 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $511.5 billion, an increase of 0.8 percent from the previous month, and 4.6 percent above October 2017.

Total sales for the August 2018 through October 2018 period were up 5.0 percent from the same period a year ago. The August 2018 to September 2018 percent change was revised from up 0.1 percent to down 0.1 percent. Retail trade sales were up 0.9 percent from September 2018, and 4.3 percent above last year. Gasoline Stations were up 16.2 percent from October 2017, while Nonstore Retailers were also up 12.1 percent (±1.4 percent) from last year.

Sixth resignation from Government in five hours (four ministers, two ministerial aides). Ranil Jayawardena resigns as PPS at the Ministry of Justice tells Theresa May: "This is not taking back control".

Walmart Inc (WMT) reported Q3 FY 2019 earnings of $1.08 per share (versus $1.00 in Q3 FY 2018), beating analysts’ consensus estimate of $1.02.

The company’s quarterly revenues amounted to $123.897 bln (+1.4% y/y), generally in-line with analysts’ consensus estimate of $124.421 bln.

WMT rose to $102.07 (+0.53%) in pre-market trading.

Cisco Systems Inc (CSCO) reported Q1 FY 2019 earnings of $0.75 per share (versus $0.61 in Q1 FY 2018), beating analysts’ consensus estimate of $0.72.

The company’s quarterly revenues amounted to $13.072 bln (+7.7% y/y), beating analysts’ consensus estimate of $12.861 bln.

CSCO rose to $46.10 (+3.99%) in pre-market trading.

The resignations of Brexit Secretary Dominic Raab and Pensions Secretary Esther McVey imperil Mrs. May's Brexit deal just hours after it was sealed. If other senior ministers decide to quit, Mrs. May could face an open challenge to her leadership

The first estimate for euro area (EA19) exports of goods to the rest of the world in September 2018 was €184.8 billion, a decrease of 1.0% compared with September 2017 (€186.6 bn). Imports from the rest of the world stood at €171.7 bn, a rise of 6.4% compared with September 2017 (€161.3 bn). As a result, the euro area recorded a €13.1 bn surplus in trade in goods with the rest of the world in September 2018, compared with +€25.3 bn in September 2017. Intra-euro area trade rose to €161.1 bn in September 2018, up by 2.2% compared with September 2017.

In January to September 2018, euro area exports of goods to the rest of the world rose to €1 686.0 bn (an increase of 3.6% compared with January-September 2017), while imports rose to €1 542.9 bn (an increase of 5.8% compared with January-September 2017). As a result the euro area recorded a surplus of €143.1 bn, compared with +€169.2 bn in January-September 2017. Intra-euro area trade rose to €1 449.8 bn in January-September 2018, up by 5.7% compared with January-September 2017.

In the three months to October 2018, the quantity bought in retail sales increased by 0.4% when compared with the previous three months; a slowdown to growth when compared with the strong summer sales, which reached a high of 2.3% in the three months to July.

In October 2018, the quantity bought fell by 0.5% when compared with September 2018, with a strong decline of 3.0% in household goods stores following a particularly strong August and September.

When compared with the previous year, the quantity bought in October 2018 increased by 2.2%, with growth across all sectors except fuel, which fell by 1.8%.

The year-on-year average store price for fuel continued to increase in October 2018 to 11.4%; this is the 26th consecutive month to show an increase.

Online sales as a total of all retailing increased to 18.0% from the 17.7% reported in September 2018, with textile, clothing and footwear stores continuing a record proportion of online sales at 18.2%; this was despite a fall in total retail spending in this sector.

Feasible to Construct Essentials of UK, EU Trade Agreement by End of Transition Period

Recommends 'Decisive' Progress in Brexit Talks

European Commission Recommendation Needed for Talks to Move to Final Phase

UK, EU Can Agree to Extend Transition Period Once for Limited Period

Now Found Solution to Ireland Border Issue

Backstop Solution for Ireland Only Kicks in If No Trade Deal at end of Transition

Single EU, UK Customs Area Would Mean No Tariffs for UK, EU Trade

Agreement Ensures UK, EU Firms Will Conpete on Level Playing Field

Cabinet Had Long, Detailed Impassioned Debate on Draft Brexit Agreement

Firmly Believe Agreement Best That Could Be Negotiated

Cabinet Backs Political Declaration

Choice Was This Deal or Back to Square One

Will Address Parliament Thursday

Firmly Believe This Decision in National Interest

EUR/USD

Resistance levels (open interest**, contracts)

$1.1449 (2580)

$1.1429 (844)

$1.1400 (116)

Price at time of writing this review: $1.1335

Support levels (open interest**, contracts):

$1.1292 (4958)

$1.1267 (2230)

$1.1238 (4122)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 7 is 125395 contracts (according to data from November, 14) with the maximum number of contracts with strike price $1,1200 (6727);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3112 (618)

$1.3090 (273)

$1.3076 (127)

Price at time of writing this review: $1.2987

Support levels (open interest**, contracts):

$1.2939 (1285)

$1.2917 (1818)

$1.2893 (1053)

Comments:

- Overall open interest on the CALL options with the expiration date December, 7 is 57495 contracts, with the maximum number of contracts with strike price $1,3100 (5218);

- Overall open interest on the PUT options with the expiration date December, 7 is 45708 contracts, with the maximum number of contracts with strike price $1,2500 (4396);

- The ratio of PUT/CALL was 0.79 versus 0.79 from the previous trading day according to data from November, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Fed Has Legal Protections, Decisions Can't Be Reversed by the Administration

Lot of Factors Weighing on Homebuilding Right Now

Housing Less of a Cyclical Driver Today

Financial Stability Risks Look Moderate

Believe US Economy Can Grow, and Grow Faster

'Don't See Much' Effect From Trade Policy Yet

Could See Slower Growth, Higher Inflation if More Products Face Tariffs

Strength of Global Economy is Very Important

This Year Seen 'Gradual Chipping Away' In Global Growth Picture

Credit Spreads Have Been Very Tight

Volcker Rule Will Remain In Force But More Efficient Once Revised

Important to Tailor Banking Regulation

Every FOMC Meeting is a 'Live Meeting'

'Very Happy' About State of the Economy

Inflation 'Right on Target'

Must Think Carefully About How Markets, Businesses React to Policy Changes

Good Reason To Think Economic Scenario Will Remain Positive

Gradual Rate Path Seeks To Balance Risks

Plan to Normalize Balance Sheet 'Going Very Well'

Trend estimates (monthly change)

Employment increased 25,400 to 12,665,800.

Unemployment decreased 7,600 to 680,300.

Unemployment rate decreased by 0.1 pts to 5.1%.

Participation rate remained steady at 65.6%.

Monthly hours worked in all jobs increased 3.6 million hours (0.2%) to 1,761.8 million hours.

Seasonally adjusted estimates (monthly change)

Employment increased 32,800 to 12,671,500. Full-time employment increased 42,300 to 8,703,700 and part-time employment decreased 9,500 to 3,967,900.

Unemployment increased 4,600 to 672,100. The number of unemployed persons looking for full-time work decreased 5,200 to 445,400 and the number of unemployed persons only looking for part-time work increased 9,800 to 226,700.

Unemployment rate remained steady at 5.0%.

Participation rate increased by 0.1 pts to 65.6%.

Monthly hours worked in all jobs increased 6.1 million hours (0.3%) to 1,764.4 million hours.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.