- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-03-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | Tertiary Industry Index | January | -0.3% | -0.3% |

| 08:30 | Eurozone | ECB's Yves Mersch Speaks | |||

| 10:00 | Eurozone | Industrial Production (YoY) | January | -4.2% | -2.1% |

| 10:00 | Eurozone | Industrial production, (MoM) | January | -0.9% | 1% |

| 12:30 | United Kingdom | Annual Budget Release | |||

| 12:30 | U.S. | Durable goods orders ex defense | January | 1.8% | |

| 12:30 | U.S. | Durable Goods Orders ex Transportation | January | 0.1% | 0.1% |

| 12:30 | U.S. | Durable Goods Orders | January | 1.2% | -0.5% |

| 12:30 | U.S. | PPI, y/y | February | 2% | 1.9% |

| 12:30 | U.S. | PPI, m/m | February | -0.1% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | February | 2.6% | 2.6% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | February | 0.3% | 0.2% |

| 14:00 | U.S. | Construction Spending, m/m | January | -0.6% | 0.4% |

| 14:30 | U.S. | Crude Oil Inventories | March | 7.069 | 2.861 |

| 17:00 | Eurozone | ECB's Benoit Coeure Speaks |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | Tertiary Industry Index | January | -0.3% | -0.3% |

| 08:30 | Eurozone | ECB's Yves Mersch Speaks | |||

| 10:00 | Eurozone | Industrial Production (YoY) | January | -4.2% | -2.1% |

| 10:00 | Eurozone | Industrial production, (MoM) | January | -0.9% | 1% |

| 12:30 | United Kingdom | Annual Budget Release | |||

| 12:30 | U.S. | Durable goods orders ex defense | January | 1.8% | |

| 12:30 | U.S. | Durable Goods Orders ex Transportation | January | 0.1% | 0.1% |

| 12:30 | U.S. | Durable Goods Orders | January | 1.2% | -0.5% |

| 12:30 | U.S. | PPI, y/y | February | 2% | 1.9% |

| 12:30 | U.S. | PPI, m/m | February | -0.1% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | February | 2.6% | 2.6% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | February | 0.3% | 0.2% |

| 14:00 | U.S. | Construction Spending, m/m | January | -0.6% | 0.4% |

| 14:30 | U.S. | Crude Oil Inventories | March | 7.069 | 2.861 |

| 17:00 | Eurozone | ECB's Benoit Coeure Speaks |

Major US stock indices have predominantly increased, as inflation data for February speaks in favor of the Fed's patient stance on future rate hikes, but the continued decline in Boeing (BA) stocks put pressure on the DJIA index.

The report of the Ministry of Labor showed that the consumer price index rose by 0.2% in February after three months in a row the figure remained unchanged. The rise in consumer prices coincided with the estimates of economists. According to the data, consumer price growth was partly due to the rebound in gasoline prices, which rose by 1.5% in February after falling by -5.5% in January. The jump in gasoline prices contributed to a 0.4% increase in energy prices and food prices (also 0.4%). Excluding food and energy prices, basic consumer prices rose 0.1% in February, after rising 0.2% in January. Economists also expected a 0.2 percent price increase. The annual consumer price growth rate slowed to 1.5% in February from 1.6% in January, while the growth rate of the basic consumer price index dropped to 2.1% from 2.2%. According to experts, the released data on the consumer price index suggest that the Fed will be patient in the matter of further raising rates, which, in turn, has a good effect on the stock market.

The value of Boeing (BA) shares fell by more than 6% after falling 5.3% on Monday, as more and more countries, including the UK, banned 737 MAX 8 aircraft after a crash in Ethiopia on Sunday. In addition, brokerage Edward Jones lowered the rating of BA shares to "Hold" ("Hold") from "Buy" ("Buy"), saying that accidents can lead to additional costs, delayed orders and put pressure on financial results.

Most of the components of DOW recorded an increase (21 of 30). The growth leader was UnitedHealth Group Incorporated (UNH, + 1.59%). The outsider was The Boeing Co. (BA; -6.08%).

Most sectors of the S & P ended in a plus. The health sector grew the most (+ 0.8%). The largest decline was in the industrial goods sector (-0.8%).

At the time of closing:

Dow 25,554.66 -96.22 -0.38%

S & P 500 2,791.57 +8.27 +0.30%

Nasdaq 100 7,591.03 +32.97 +0.44%

- We are not preparing for and do not want a general election

- May has said any extension should be as short as possible

- PM could meet colleagues later

- We have come "very close" to agreement with China on currency issues

Portugal inflation accelerates in February

Statistics Portugal reported on Tuesday the consumer price index (CPI) rose 0.94 percent y-o-y in February, following a 0.48 percent y-o-y advance in January. The rate was the highest since October last year.

Meanwhile, core inflation, which excludes energy and unprocessed food products, accelerates to 1.0 percent in February from 0.8 percent in the previous month.

On a month-on-month basis, consumer prices fell 0.2 percent in February after a 1.2 percent decline in the prior month.

Inflation based on the EU measure of harmonized index for consumer prices (HICP) rose to 0.9 percent y-o-y in February, following a 0.6 percent y-o-y rise in January.

- Policymakers will calibrate loans based on growth figures

- ECB Committee proposed new TLTRO premium at 25 bps above main refinancing rate but governors pushed back saying it was too figh

- A key goal of new TLTRO conditions is to reduce the stock of loans to avoid future cliff effect

- Best TLTRO rate not seen going below zero though the discussion is still ongoing and growth weakness could change terms

- ECB did not discuss tiered deposit, only one governor expressed deep concern about negative rates

U.S. stock-index rose mostly on Tuesday, after official data showed U.S. consumer prices increased for the first time in four months in February, but Boeing’s (BA) drop for the second day weighed on the Dow futures.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,503.69 | +378.60 | +1.79% |

Hang Seng | 28,920.87 | +417.57 | +1.46% |

Shanghai | 3,060.31 | +33.31 | +1.10% |

S&P/ASX | 6,174.80 | -5.40 | -0.09% |

FTSE | 7,147.64 | +17.02 | +0.24% |

CAC | 5,255.64 | -10.32 | -0.20% |

DAX | 11,519.71 | -23.77 | -0.21% |

Crude | $57.30 | +0.90% | |

Gold | $1,298.3 | +0.56% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 207.37 | 0.27(0.13%) | 209 |

ALTRIA GROUP INC. | MO | 56.05 | 0.04(0.07%) | 3242 |

Amazon.com Inc., NASDAQ | AMZN | 1,670.02 | -0.60(-0.04%) | 32349 |

Apple Inc. | AAPL | 180.08 | 1.18(0.66%) | 161579 |

AT&T Inc | T | 30.27 | 0.05(0.17%) | 11166 |

Boeing Co | BA | 386.35 | -13.66(-3.41%) | 346915 |

Caterpillar Inc | CAT | 133.9 | 0.79(0.59%) | 2036 |

Cisco Systems Inc | CSCO | 52.13 | 0.21(0.40%) | 13353 |

Exxon Mobil Corp | XOM | 80.17 | 0.39(0.49%) | 2461 |

Facebook, Inc. | FB | 172.3 | 0.23(0.13%) | 63586 |

FedEx Corporation, NYSE | FDX | 176 | -0.45(-0.26%) | 408 |

Ford Motor Co. | F | 8.62 | 0.01(0.12%) | 670 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.49 | 0.13(1.05%) | 14489 |

General Electric Co | GE | 9.91 | 0.01(0.10%) | 124452 |

Goldman Sachs | GS | 196 | 0.03(0.02%) | 1490 |

Google Inc. | GOOG | 1,176.87 | 1.11(0.09%) | 3720 |

Hewlett-Packard Co. | HPQ | 19 | 0.12(0.64%) | 775 |

Home Depot Inc | HD | 183.25 | 0.81(0.44%) | 3011 |

Intel Corp | INTC | 53.3 | -0.05(-0.09%) | 44196 |

Johnson & Johnson | JNJ | 138.35 | -0.21(-0.15%) | 8922 |

JPMorgan Chase and Co | JPM | 104.75 | 0.40(0.38%) | 6746 |

Merck & Co Inc | MRK | 81.06 | 0.19(0.23%) | 128 |

Microsoft Corp | MSFT | 113.2 | 0.37(0.33%) | 37516 |

Nike | NKE | 85.72 | -0.10(-0.12%) | 1877 |

Pfizer Inc | PFE | 41.56 | 0.06(0.14%) | 8008 |

Procter & Gamble Co | PG | 99.46 | -0.12(-0.12%) | 468 |

Starbucks Corporation, NASDAQ | SBUX | 69.79 | 0.11(0.16%) | 6521 |

Tesla Motors, Inc., NASDAQ | TSLA | 286.75 | -4.17(-1.43%) | 125163 |

The Coca-Cola Co | KO | 45.96 | -0.22(-0.48%) | 25498 |

Twitter, Inc., NYSE | TWTR | 31.06 | 0.19(0.62%) | 18870 |

UnitedHealth Group Inc | UNH | 243.9 | 0.75(0.31%) | 1378 |

Verizon Communications Inc | VZ | 57.75 | 0.17(0.30%) | 1769 |

Visa | V | 151.26 | 0.59(0.39%) | 8999 |

Wal-Mart Stores Inc | WMT | 98.6 | 0.12(0.12%) | 1990 |

Walt Disney Co | DIS | 114.91 | 0.16(0.14%) | 1616 |

Yandex N.V., NASDAQ | YNDX | 36.04 | 0.04(0.11%) | 3210 |

Tesla (TSLA) target lowered to $260 from $283 at Morgan Stanley; maintains Equal Weight

Boeing (BA) downgraded to Hold from Buy at Edward Jones

Credit Suisse (CS) downgraded to Underperform from Mkt Perform at Keefe Bruyette

Coca-Cola (KO) downgraded to Hold from Buy at HSBC Securities; target lowered to $50

The Labor Department announced on Tuesday the U.S. consumer price index (CPI) rose 0.2 percent m-o-m in February after being unchanged m-o-m drop in January.

Over the last 12 months, the CPI rose 1.5 percent y-o-y last month, following a 1.6 percent m-o-m gain in the 12 months through January. That was the lowest rate since September of 2016.

Economists had forecast the CPI to increase 0.2 percent m-o-m and 1.6 percent y-o-y in the 12-month period.

According to the report, the indexes for shelter (+0.3 percent m-o-m) and food (+0.4 percent m-o-m) increased, and the gasoline index (+1.5 percent m-o-m) rebounded after three consecutive monthly declines to result in the seasonally adjusted all items increase.

Meanwhile, the core CPI excluding volatile food and fuel costs edged up 0.1 percent m-o-m in February, following a 0.2 percent m-o-m advance in the previous month.

In the 12 months through February, the core CPI rose 2.1 percent, after increasing 2.2 percent for the 12 months ending January. That marked the smallest annual increase in core consumer prices since October last year.

Economists had forecast the core CPI to rise 0.2 percent m-o-m and 2.2 percent y-o-y last month.

The Hellenic Statistical Authority reported on Tuesday, Greece's consumer price index (CPI) rose 0.6 percent y-o-y in February after a 0.4 percent y-o-y advance January.

According to the report, the biggest increase was in communication, where costs increased 6.2 percent y-o-y, followed by a 2.1 percent y-o-y climb in prices of food and non-alcoholic beverages. At the same time, clothing and footwear fell the most, down 2.7 percent y-o-y in February.

On a monthly basis, consumer prices edged up 0.1 percent in February, after dropping 1.8 percent in the previous month.

Meanwhile, the harmonized index of consumer prices (HICP) increased 0.8 percent y-o-y in February, following a 0.5 percent y-o-y gain in January. That marked the fastest inflation pace in three months.

In m-o-m terms, the HICP rose 0.3 percent after a 1.3 percent decline in January. That was the first increase in four months.

- We are far less likely to go into the backstop

Statistics Sweden reported on Tuesday, consumer prices climbed 1.9 percent y-o-y in February, the same pace of increase as in January.

Economists had expected the inflation rate to rise to 2.0 percent.

On a monthly basis, consumer prices increased 0.7 percent in February, after falling 1.0 percent in the previous month. That marked the biggest gain since February last year.

According to the report, the monthly advance was attributable to higher prices for food and non-alcoholic beverages, clothing as well as higher transport costs.

Prime Minister Theresa May’s deal offers the best solution on Brexit, said French European Affairs Minister Nathalie Loiseau on Tuesday, ahead of a crucial vote in the British parliament on May’s proposal.

“The withdrawal agreement that Theresa May is putting before the House of Commons is the best solution for Brexit. The European Union has brought over all the necessary clarifications. The choice is now with the United Kingdom: a smooth exit or a brutal separation”, added Loiseau.

Analysts at TD Securities are expecting the US CPI to stabilize at 1.6% in February, reflecting a 0.2% m/m with risk for a 0.3% print.

“Price pressures will benefit higher food and gasoline prices and another solid 0.2% increase in core CPI, leaving the latter unchanged at 2.2% y/y. There is risk for a slight deceleration in shelter, but we expect strength elsewhere, including tariff-related categories, medical care and airfares.”

According to the report from National Federation of Independent Business (NFIB), the Small Business Optimism Index improved modestly in February, increasing 0.5 points to 101.7. Views about future capital outlays. Earnings trends weakened, as a million laid off workers and others affected by the shutdown cut back on spending. The loss of sales falls right to the bottom line. Worker compensation and selling prices were lower in February than they were in January, but job openings rebounded remaining at historically high levels. The Uncertainty Index fell 1 point to 85, a small decline but still showing a lot of residual uncertainty from the government shutdown.

Small business owners who expect better business conditions improved five percentage points and those viewing the current period as a good time to expand increased two points in February. Twenty-seven percent plan capital outlays in the next few months, up one point. Plans to invest were most frequent in wholesale trades (43 percent), manufacturing (39 percent), construction (32 percent), and agriculture (31 percent). business conditions and the current period as a good time to expand improved as did plans to make

Office for National Statistics said, production output rose by 0.6% between December 2018 and January 2019; the manufacturing sector provided the largest upward contribution, rising by 0.8%, its first monthly rise since June 2018.

In January 2019, the monthly increase in manufacturing output was due to rises in 8 of the 13 subsectors and follows a 0.7% fall in December 2018; the largest upward contribution came from pharmaceuticals, which rose by 5.7%.

Production output fell by 0.8% in the three months to January 2019, compared with the three months to October 2018, due to falls in three main sectors. The three-monthly decrease of 0.7% in manufacturing is due mainly to large falls of 4.0% from basic metals and metal products and 2.0% from transport equipment.

In the three months to January 2019, production output decreased by 1.0% compared with the same three months to January 2018; driven by a fall of 1.5% from manufacturing.

According to the report from Office for National Statistics, UK gross domestic product (GDP) grew by 0.2% in Quarter 4 2018. A large positive contribution from the services sector was partially offset by smaller negative contributions from the production and construction sectors. Growth in the services sector was 0.4% in Quarter 4 (Oct to Dec) 2018. Meanwhile, the production industries contracted by 1.1% and construction contracted by 0.3%. These growths mean that the services sector was the only positive contributor to gross domestic product (GDP) growth in Quarter 4, while the other two sectors had negative contributions.

Headline annual gross domestic product (GDP) growth was 1.4% in 2018, the lowest it has been in six years. Meanwhile, the services sector had annual growth of 1.7%, the lowest since 2011 and the production sector had annual growth of 0.7%, the lowest since 2013. Construction annual growth was 0.6%, the lowest since 2012.

Karen Jones, analyst at Commerzbank, suggests that the GBP/USD pair has sold off to and bounced from the short term uptrend at 1.2959 and provided this holds we should see the market rally towards the 1.3363 July 2018 high.

“Overall target remains the 1.3584 200 week MA. Below the 1.2959 short term uptrend lies the double Fibo retracement at 1.2900/1.2895. This guards the recent low at 1.2772. Below 1.2772 we would allow for losses to the 1.2669/62 15th January low and August low and possibly the 1.2609/78.6% retracement.”

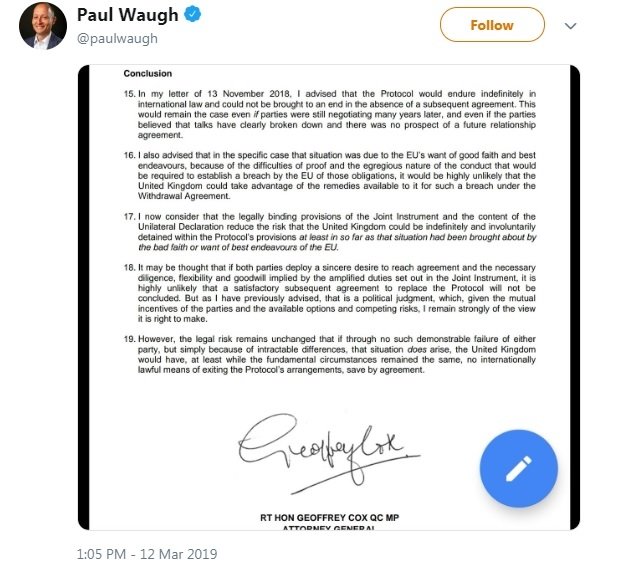

we now do have greater clarity, but need to hear what the attorney general has to say

what attorney General Cox cites is very important, but will make our own decision

agreement offers prospect of greater legal clarity around withdrawal treaty

taking time this morning to study the agreement and will take legal counsel

DUP’s view will heavily influence many lawmakers

my focus will be whether the unilateral declaration is genuinely unilateral

waiting to see what group of lawyers state on UK PM May’s deal from 9AM

would be better to have vote tomorrow when we have had ‘mature’ consideration

Outcome of agreement is positive, hopes it will be endorsed by UK parliament

Documents complement withdrawal agreement, declaration

Further text should eliminate fears

Withdrawal agreement is a fair compromise for all sides

ANZ analysts note that the China’s Producer’s Price Index (PPI) contracted by 0.1% m/m in February.

“The deflation in the PPI will be detrimental to industrial profits, which in turn will dampen wage growth and investment activity. There is some evidence that US-China trade tensions, an external factor over which China has had little control, has weighed on manufacturing goods (midstream) prices which in turn has compounded the weakness in the headline PPI. Since the trade war may result in excess supply for some Chinese industries, this will likely fuel a disinflationary impulse in the country’s PPI which will have spill-over effects for other economies. The contraction in China’s PPI could be broader and deeper if trade tensions extend into the second half of the year.”

The International Monetary Fund said that South Korea should draw up an extra fiscal budget to support an economy facing risks from sluggish investment and global trade risks.

"The authorities should provide more fiscal stimulus through a supplementary budget, with measures that promote potential output," IMF mission chief Tarhan Feyzioglu told.

Feyzioglu said risks are tilted toward the downside as growth is moderating amid weak inflation and vanishing jobs.

Few economic forces have scale, persistence and systemic risk of climate change.

Outcomes from climate modelling need to be mapped into economic modelling.

Need to think of climate change as a trend rather than a cycle.

China will avoid big fluctuations in the property market to maintain the principle that "houses are for living, not for speculation", the housing minister said.

Housing Minister Wang Menghui spoke after a report delivered by Premier Li Keqiang last week omitted the wording that "houses are for living, not for speculation", stirring speculation that more cities will risk loosening curbs on home buyers amid a slowing economy.

"We will keep property policymaking persistent and stable, and avoid the situation where prices would rise or fall sharply," Wang told.

To address the structural imbalance in the housing market, China will "vigorously" push forward with development of the rental housing market this year, Wang said.

Central bank excludes temporary factors when gauging inflation trend

Deflationary mindset of households, companies and corporate streamlining are among factors weighing on inflation

BoJ should do utmost to hit inflation target now

Exit strategy talk should start when inflation target is in sight

BoJ can exit smoothly when it is needed

Will communicate to markets the strategy for exiting at some point

"I don't think anyone in the general public is angry about the fact that inflation hasn't reached 2 percent," Aso told parliament, when asked his view on whether the Bank of Japan should persist in meeting the elusive price goal.

Other major central banks, such as the ECB, are more flexible about their inflation targets with room for some allowance, Aso said. "I believe (the BOJ) could be a bit more flexible too," he added.

According to the report from Insee, in Q4 2018, net payroll job creation reached 53,600, that is an increase of +0.2% after +0.1% in the previous quarter. Almost stable in the public sector (+2,800 jobs after −3,000 jobs), payroll employment increased more significantly in the private sector (+50,700 jobs after +32,200 jobs). Year on year, it rose by 149,600 net jobs (+0.6%): +160,300 jobs in the private sector and −10,700 jobs in the public service.

In Q4 2018, payroll employment increased by +6,500 jobs in industry (that is +0.2%, after 0.0%). Over a year it increased by 9,500 jobs (that is +0.3%). The growth of payroll employment in construction remained solid : +6,300 (that is +0.5%), after +5,700 in the previous quarter (that is +0.4%). Year on year, the increase reached +25,600 jobs (that is +1.9%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1409 (1326)

$1.1386 (396)

$1.1368 (347)

Price at time of writing this review: $1.1255

Support levels (open interest**, contracts):

$1.1214 (2903)

$1.1176 (2796)

$1.1134 (3924)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 5 is 68564 contracts (according to data from March, 11) with the maximum number of contracts with strike price $1,1350 (4213);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3346 (324)

$1.3313 (309)

$1.3287 (815)

Price at time of writing this review: $1.3199

Support levels (open interest**, contracts):

$1.3053 (1073)

$1.3027 (713)

$1.2969 (1235)

Comments:

- Overall open interest on the CALL options with the expiration date April, 5 is 23322 contracts, with the maximum number of contracts with strike price $1,3400 (4305);

- Overall open interest on the PUT options with the expiration date April, 5 is 21010 contracts, with the maximum number of contracts with strike price $1,2500 (1715);

- The ratio of PUT/CALL was 0.90 versus 0.90 from the previous trading day according to data from March, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 66.49 | 1.17 |

| WTI | 56.95 | 1.06 |

| Silver | 15.29 | -0.13 |

| Gold | 1293.366 | -0.45 |

| Palladium | 1534.58 | 1.42 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 99.53 | 21125.09 | 0.47 |

| Hang Seng | 274.88 | 28503.3 | 0.97 |

| KOSPI | 0.66 | 2138.1 | 0.03 |

| ASX 200 | -23.6 | 6180.2 | -0.38 |

| FTSE 100 | 26.31 | 7130.62 | 0.37 |

| DAX | 85.64 | 11543.48 | 0.75 |

| Dow Jones | 200.64 | 25650.88 | 0.79 |

| S&P 500 | 40.23 | 2783.3 | 1.47 |

| NASDAQ Composite | 149.92 | 7558.06 | 2.02 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.70696 | 0.39 |

| EURJPY | 125.09 | 0.22 |

| EURUSD | 1.1248 | 0.15 |

| GBPJPY | 146.632 | 1.45 |

| GBPUSD | 1.31857 | 1.38 |

| NZDUSD | 0.68318 | 0.41 |

| USDCAD | 1.33928 | -0.12 |

| USDCHF | 1.01022 | 0.23 |

| USDJPY | 111.205 | 0.08 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.