- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-02-2019

The EU’s chief Brexit negotiator Michel Barnier wrote on Twitter that he would reiterate on Monday at a planned meeting with Britain’s Brexit minister Steve Barclay that the EU would not reopen the Brexit deal, but was ready to rework the political declaration that accompanies it.

He tweeted: "I am looking forward to meeting @SteveBarclay in Brussels on Mon evening. I will listen to how the UK sees the way through. The EU will not reopen the Withdrawal Agreement. But I will reaffirm our openness to rework the Political Declaration in full respect of #EUCO guidelines".

U.S. stock-index fell on Friday, as investor sentiment was subdued by recurring concerns about a U.S.-China trade deal, slowing global growth, and an understanding that the market was due for a breather.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,333.17 | -418.11 | -2.01% |

Hang Seng | - | - | - |

Shanghai | 27,946.32 | -43.89 | -0.16% |

S&P/ASX | 6,071.50 | -21.00 | -0.34% |

FTSE | 7,088.47 | -5.11 | -0.07% |

CAC | 4,972.92 | -12.64 | -0.25% |

DAX | 10,952.63 | -69.39 | -0.63% |

Crude | $52.93 | +0.55% | |

Gold | $1,318.50 | +0.33% |

Statistics Canada reported that the number of employed people rose by 66,800 m-o-m (+0.4 percent m-o-m) in January, exceeding economists’ forecast for an 8,000 increase and after an unrevised advance of 9,300 in the previous month.

Meanwhile, Canada's unemployment rate rose 0.2 percentage points m-o-m to 5.8 percent as more people looked for work. Economists had forecast the reading to increase to 5.7 percent.

According to the report, full-time employment increased by 30,900 (+0.2percent m-o-m) in January, while part-time jobs rose 36,000 (+1.0 percent m-o-m).

In January, the number of private sector employees climbed by 111,5000 (+0.9 percent m-o-m), while the number of public sector employees grew by 15,900 (+0.4 percent m-o-m). At the same time, the number of self-employed dropped by 60,700 m-o-m (-2.1 percent m-o-m) last month.

Sector-wise, there were more people working in services-producing industries (+99,000 in January), led by wholesale and retail trade (34,000), professional, scientific and technical services (29,000), and public administration (21,000).

On a year-over-year basis, employment rose by 327,000 (or 1.8 percent), reflecting increases in both full-time (+166,000) and part-time (+162,000) work.

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 27 | -0.29(-1.06%) | 1850 |

ALTRIA GROUP INC. | MO | 48.51 | -0.21(-0.43%) | 16856 |

Amazon.com Inc., NASDAQ | AMZN | 1,591.00 | -23.37(-1.45%) | 78059 |

Apple Inc. | AAPL | 169.32 | -0.89(-0.52%) | 200590 |

AT&T Inc | T | 29.42 | -0.03(-0.10%) | 43338 |

Boeing Co | BA | 402.5 | -2.67(-0.66%) | 12598 |

Caterpillar Inc | CAT | 127.99 | -0.79(-0.61%) | 1737 |

Chevron Corp | CVX | 118.2 | -0.03(-0.03%) | 3264 |

Cisco Systems Inc | CSCO | 46.49 | -0.21(-0.45%) | 29900 |

Citigroup Inc., NYSE | C | 62.58 | -0.23(-0.37%) | 5730 |

Exxon Mobil Corp | XOM | 73.67 | -0.19(-0.26%) | 11945 |

Facebook, Inc. | FB | 164.79 | -1.59(-0.96%) | 143163 |

FedEx Corporation, NYSE | FDX | 180 | -1.37(-0.76%) | 1032 |

Ford Motor Co. | F | 8.29 | -0.02(-0.24%) | 103954 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.91 | 0.05(0.42%) | 2124 |

General Electric Co | GE | 10.04 | -0.03(-0.25%) | 289624 |

General Motors Company, NYSE | GM | 38.5 | -0.15(-0.39%) | 19422 |

Goldman Sachs | GS | 192 | -1.07(-0.55%) | 636 |

Google Inc. | GOOG | 1,089.15 | -9.56(-0.87%) | 2698 |

HONEYWELL INTERNATIONAL INC. | HON | 145 | -3.15(-2.13%) | 119 |

Intel Corp | INTC | 48.87 | -0.36(-0.73%) | 21426 |

International Business Machines Co... | IBM | 132.69 | -0.50(-0.38%) | 5207 |

Johnson & Johnson | JNJ | 131.94 | -0.11(-0.08%) | 710 |

JPMorgan Chase and Co | JPM | 101.99 | -0.39(-0.38%) | 1297 |

McDonald's Corp | MCD | 174.42 | -0.86(-0.49%) | 1075 |

Merck & Co Inc | MRK | 76.05 | -0.77(-1.00%) | 337 |

Microsoft Corp | MSFT | 104.65 | -0.62(-0.59%) | 61576 |

Nike | NKE | 82.38 | -0.01(-0.01%) | 3563 |

Pfizer Inc | PFE | 41.53 | -0.17(-0.41%) | 1476 |

Procter & Gamble Co | PG | 96.6 | -0.54(-0.56%) | 783 |

Starbucks Corporation, NASDAQ | SBUX | 68.57 | -0.57(-0.82%) | 6449 |

Tesla Motors, Inc., NASDAQ | TSLA | 305.97 | -1.54(-0.50%) | 54593 |

The Coca-Cola Co | KO | 49.28 | -0.14(-0.28%) | 232 |

Twitter, Inc., NYSE | TWTR | 30.6 | -0.20(-0.65%) | 149991 |

United Technologies Corp | UTX | 120 | -0.72(-0.60%) | 952 |

Verizon Communications Inc | VZ | 53.55 | -0.02(-0.04%) | 505 |

Visa | V | 139.7 | -0.47(-0.34%) | 1687 |

Wal-Mart Stores Inc | WMT | 96.53 | -0.20(-0.21%) | 1209 |

Walt Disney Co | DIS | 110.49 | -0.46(-0.41%) | 6113 |

Yandex N.V., NASDAQ | YNDX | 32.92 | -0.11(-0.33%) | 9865 |

The Canada Mortgage and Housing Corp. (CMHC) reported the seasonally adjusted annual rate of housing starts was 207,968 units in January 2019, down from an upwardly revised 213,630 units in December 2018 (originally 213,419).

Economists had forecast an annual pace of 205,000 for January.

According to the report, urban starts decreased 2.1 percent m-o-m last month to 190,912, as single-detached urban starts fell by 10.4 percent m-o-m, to 44,559 units, while multiple urban starts rose by only 0.7 percent m-o-m to 146,353 units. At the same time, rural starts were estimated at a seasonally adjusted annual rate of 17,056 units (-8.2 percent m-o-m).

Arconic (ARNC) reported Q4 FY 2018 earnings of $0.33 per share (versus $0.31 in Q4 FY 2017), beating analysts’ consensus estimate of $0.30.

The company’s quarterly revenues amounted to $3.472 bln (+6.1% y/y), generally in line with analysts’ consensus estimate of $3.475 bln.

ARNC rose to $18.05 (+2.09%) in pre-market trading.

The BBC reported that several cabinet ministers have told it a no-deal Brexit could lead to a vote on Irish unification.

One senior minister said the prospect is "very real" and very much on the prime minister's mind.

A second cabinet minister warned the government risked "sleepwalking into a border poll".

And a third cabinet minister said there was an understanding in government that a vote on unification would be a "realistic possibility" if the UK exit the EU without a deal next month.

"If we are party to creating an environment of chaos, disruption and uncertainty - that could move the dial", the source told.

All three spoke to the BBC on condition of anonymity.

Iceland’s government announced on Friday that the UK and three EEA EFTA States (Iceland, Liechtenstein, and Norway) have reached an agreement on citizens’ rights should Britain leave the European Union without a withdrawal agreement.

“The agreement protects the rights of EEA EFTA citizens living in the UK and British citizens living in the EEA EFTA states, providing certainty that they can continue to do so in the event of a no-deal Brexit,” the Icelandic government said in a statement.

“This means that citizens’ residence rights have been secured regardless of the outcome of the negotiations between the EU and the UK,” Iceland, an EU outsider, added.

India could lose a vital U.S. trade concession, under which it enjoys zero tariffs on $5.6 billion of exports to the United States, amid a growing dispute over its trade and investment policies, people with close knowledge of the matter told Reuters.

According to Reuters, a move to withdraw the Generalised System of Preferences (GSP) from India, the world’s largest beneficiary of a scheme that has been in force since the 1970s, would be the strongest punitive action since President Donald Trump took office in 2017 vowing to reduce the U.S. deficit with large economies.

Trump has repeatedly called out India for its high tariffs.

The trigger for the latest downturn in trade ties of both countries was India’s new rules on e-commerce that restrict the way Amazon.com Inc. (AMZN) and Walmart-backed Flipkart do business in a fast-growing online market set to reach $200 billion by 2027.

That, coming on top of a drive to force global card payments companies such as Mastercard and Visa to move their data to India and the imposition of higher tariffs on electronic products and smartphones, left a broader trade package the two sides were working on through last year in tatters.

The Organisation for Economic Cooperation and Development (OECD) said on Friday that the government borrowing in member states is set to reach a new high this year mainly due to increased U.S. borrowing.

According to the organization's annual sovereign borrowing outlook, gross borrowing among OECD countries on debt markets is expected to top $11 trillion in 2019, exceeding the previous record of $10.9 trillion recorded in 2010.

“While government funding needs in the wake of the financial crisis increased in most OECD countries, the recent further increase is confined to a few countries, particularly the United States,” the OECD said.

The first of the three options reported is a 10% levy, which would make US tariffs equal to that of the EU.

The second option is customised levies, which would be limited to certain cars and their respective components.

The final option is that of a 25% levy, which was the proposal that was being touted originally.

The US Department of Commerce is expected to present the investigative report after the so-called Chapter 232 on 17 February. After that, US President Donald Trump has 90 days to make a final decision.

"I think increasing tariffs is not a good idea," Scholz said, in response to speculation that the U.S. could apply tariffs to car imports from Europe in the coming weeks.

"I hope things like this could be avoided," he added saying he also hoped the issue wouldn't get confrontational.

"The best thing we can do for growth and wealth is rules-based free trade. I hope that we will have a better situation so that we can get again more global trade agreements."

Recent data confirm that the deceleration of the World economy has spilled over into Q4 2018, particularly in the industrial sector, which has experienced a broad-based loss of momentum

In Q4, Italian GDP decreased with respect to the previous quarter for the second time in a row conditioned by the negative performance of domestic demand.

In the labour market, employment stabilized and the unemployment rate decreased only marginally.

Prices decelerated due to the fall in the energy components and the inflation differential with respect to the euro area widened.

In January 2019, the consumer confidence improved while the composite business climate indicator decreased further.

The leading indicator experienced a sharp fall suggesting a worsening of the Italian cyclical position in the coming months.

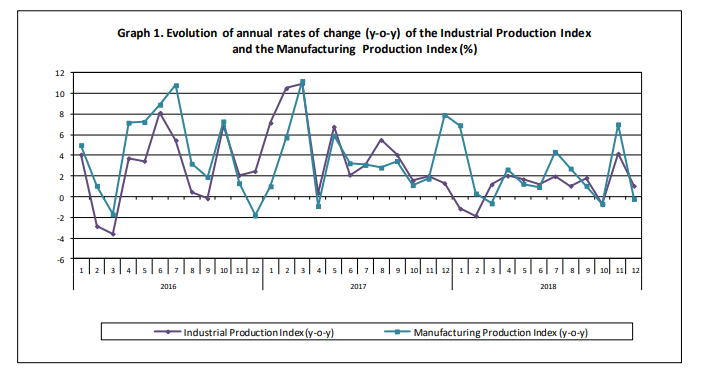

According to the report from Hellenic Statistical Authority, the Overall Industrial Production Index in December 2018 recorded an increase of 1.1% compared with December 2017.

The corresponding annual rate of change of the Overall IPI in December 2017 was 1.3%.

The average Overall Industrial Production Index for the period from January to December 2018 recorded an increase of 1.0% compared with the average IPI of the period from January to December 2017/

The seasonally adjusted Overall Industrial Production Index in December 2018 recorded a decrease of 1.1% compared with November 2018.

German Finance Minister Olaf Scholz acknowledged that a slower growth of Europe’s largest economy would lead to lower tax receipts and increased pressure on the budget.

The German economy was still continuing to move forward, and employment was at a “truly remarkable” high, the center-left minister said.

“A lot of companies are very confident about their future prospects”, added Scholz.

Scholz also commented the situation around Brexit:

Irish border is the most difficult political question

It is an issue of peace and must have a good solution

Hopes it will be done in the next few days

Hopes there will be an agreement on Brexit by 29 March

No one expected that we would not know yet what will happen with Brexit

We are prepared for hard Brexit in Germany

Asked during an event in the Oval Office whether there would be a meeting before the deadline, set by the two countries to achieve a trade deal, Trump said: “No.”

When asked whether there would be a meeting in the next month or so, Trump said: “Not yet. Maybe. Probably too soon. Probably too soon.”

The remarks confirmed comments from administration officials who said the two men were unlikely to meet before the deadline, dampening hopes of a quick trade pact.

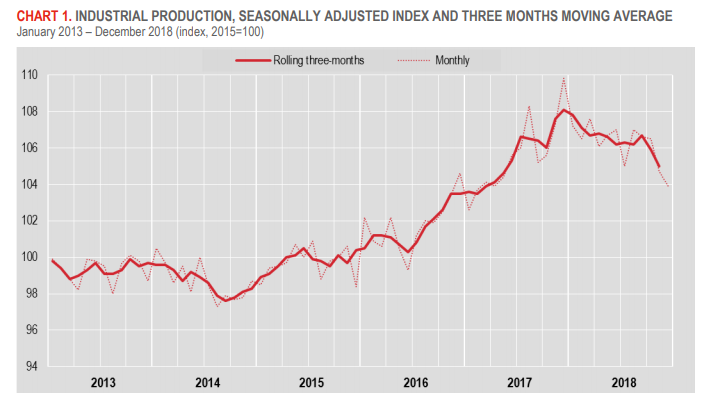

According to the report from Istat, in December 2018 the seasonally adjusted industrial production index decreased by 0.8% compared with the previous month. Economists had expected a 0.4% increase. The percentage change of the average of the last three months with respect to the previous three months was -1.1.

The calendar adjusted industrial production index decreased by 5.5% compared with December 2017 (calendar working days being 19 versus 18 days in December 2017); for the whole year 2018 the percentage change was +0.8 compared with 2017. The unadjusted industrial production index decreased by 2.5% compared with December 2017

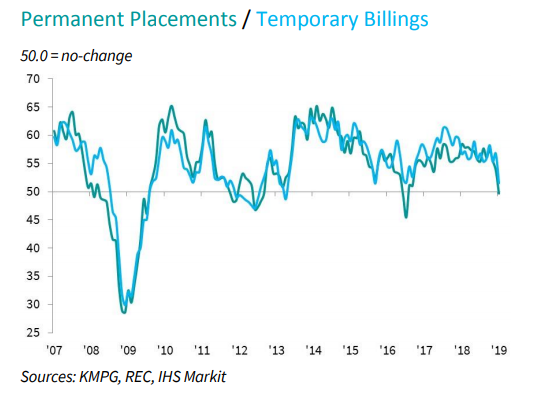

According to the latest KPMG and REC, UK Report on Jobs, rising economic uncertainty and ongoing candidate shortages weighted on UK labour market performance at the start of 2019.

The permanent jobs placement index in the monthly KPMG/Recruitment and Employment Confederation (REC) Report on Jobs fell to 49.7 from 53.7, below the 50 dividing line between growth and contraction for the first time since just after 2016's referendum on leaving the European Union. The overall number of vacancies for staff increased at the slowest rate since October 2016.

Latest data also showed that worker availability to take up new roles continued to decline. This was primarily linked to high UK employment levels, but also hesitancy amongst workers to switch positions given heightened Brexit uncertainty. Pay pressures subsequently remained high, with salaries and temp wages both increasing strongly since December.

According to the report from Insee, in Q4 2018, private payroll employment increased slightly: +0.1%, at the same pace than in the previous quarter, that is +16,200 jobs after +23,000 jobs in Q3 2018. Year on year, private payroll employment slowed down :+0.5% (that is +106,100 jobs) after +1,0% in Q3 2018. Excluding temporary employment, it increased by +0.2% over the quarter (that is +28,200 jobs) and by +0.7% over the year (that is +135,100 jobs).

Private payroll employment slowed down a little in construction (+0.2%, +2,700 jobs, after +0.4 % jobs) and fell slightly back in industry (−0.1%, −2,400 jobs, after 0.0%). Year on year, private employment increased by 19,000 in construction, whereas it declined in industry (that is −3,300 jobs).

In Q4 2018, in market services, private employment increased moderately again: +0.1% (that is +13,000 jobs), as in Q3 2018, bringing its rise to 82,200 over a year. Excluding temporary employment, its increase was slightly higher: +0.2%, (that is +25,000 jobs), as in the previous quarter. Private employment in non-market services increased softly again over the quarter (+0.1% after 0.0%) ; it was almost stable over a year (+0.1%). In Q4 2018, the decline in temporary employment continued : −1.5% after −1.1% (that is −12,000 jobs, after −9,200). Year on year, temporary employment went down sharply (−3.6%, −29,000 jobs).

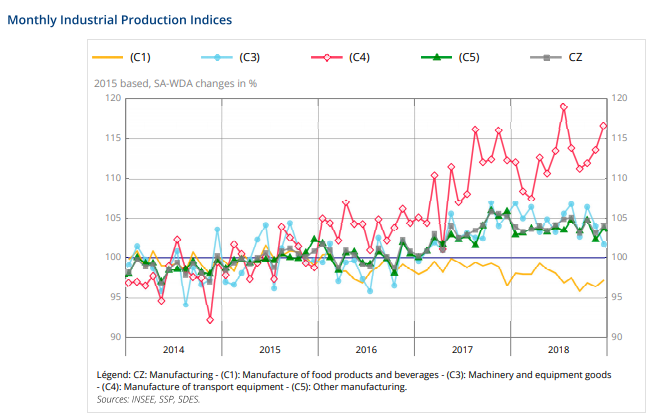

In December 2018, output bounced back in the manufacturing industry (+1.0% after −1.5% in November) as well as in the whole industry (+0.8% after −1.5%).

Manufacturing output went down over the last quarter (−0.4%), as well as in the whole industry (−0.5%). Over the last quarter, output decreased in mining and quarrying, energy, water supply (−0.8%), in “other manufacturing” (−0.2%), in the manufacture of machinery and equipment goods (−0.9%), in the manufacture of transport equipment (−0.5%) and more markedly in the manufacture of coke and refined petroleum products (−6.6%). Conversely, it was virtually stable in the manufacture of food products and beverages (+0.1%).

Manufacturing output of the last quarter diminished compared to the same quarter of 2017 (−1.5%), as well as in the whole industry (−1.4%). Over a year, output also decreased sharply in “other manufacturing” (−1.9%), in the manufacture of machinery and equipment goods (−1.4%), in the manufacture of food products and beverages (−1.4%), in mining and quarrying, energy, water supply (−0.9%) and more markedly in the manufacture of coke and refined petroleum products (−7.1%). On the contrary, it increased slightly in the manufacture of transport equipment (+0.4%).

cuts GDP forecasts, sees 2.8 pct y/y Dec 2018, 3.0 pct Dec 2019, 2.7 pct Dec 2020, 2.7 pct June 2021

lowers inflation forecasts, trimmed mean at 2.0 pct y/y Dec 2019, 2.1 pct Dec 2020, 2.2 pct June 2021

sees unemployment at 5.0 pct Dec 2019, 4.9 pct Dec 2020, 4.8 pct June 2021

sees wage price index 2.4 pct y/y Dec 2018, 2.5 pct Dec 2019, 2.6 pct Dec 2020, 2.6 pct June 2021

outlook for business investment positive, see y/y growth 4.8 pct Dec 2019, 4.9 pct Dec 2020

global growth running at solid pace, growth in trade partners seen around trend

recent downturn in business surveys, if sustained, would imply weaker investment, employment

Probability of rate rise or cut more evenly balanced than previously

board does not see strong case to move rates in the near term

board judges progress on inflation, unemployment can be "reasonably expected"

if progress is made, higher rates would be appropriate at some point

might lower rates if there was a sustained rise in unemployment, too low inflation

resilience of household consumption is a "key uncertainty"

unsure whether income growth will rise enough to offset drag from falling house prices

household reaction to fall in home prices is a "significant uncertainty"

labour market remains strong, leading indicators imply above average growth

housing credit conditions tighter than have been for some time

Federal Statistical Office (Destatis) said, in December 2018, Germany exported goods to the value of 96.1 billion euros (-4.5% compared with December 2017) and imported goods to the value of 82.1 billion euros (nearly unchanged on the same month a year earlier). As a result, Germany trade surplus decreased to €13.9 billion from € 20.4 billion in November. After calendar and seasonal adjustment, exports were up 1.5% and imports 1.2% compared with November 2018. That meant the trade surplus widened to €19.4 billion from €18.4 billion the month before.

In 2018, Germany exported goods to the value of 1,317.9 billion euros and imported goods to the value of 1,090.0 billion euros. Based on provisional data, German exports increased by 3.0% and imports by 5.7% in 2018 year on year. Exports and imports in 2018 exceeded the record highs recorded in 2017 when goods had been exported to the value of 1,279.0 billion euros and imported to the value of 1,031.0 billion euros. The foreign trade balance showed a surplus of 227.8 billion euros in 2018. In 2017, the surplus of the foreign trade balance was 247.9 billion euros.

In 2018, Germany exported goods to the value of 778.7 billion euros to the Member States of the European Union (EU), while it imported goods to the value of 623.0 billion euros from those countries. Compared with 2017, exports to the EU countries increased by 3.8%, and imports from those countries by 6.3%. Goods to the value of 492.0 billion euros (+4.5%) were dispatched to the Euro area countries in 2018, while the value of the goods received from those countries was 405.0 billion euros (+6.9%).

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 249.1 billion euros in 2018, which takes into account the balances of trade in goods including supplementary trade items (+242.0 billion euros), services (-16.7 billion euros), primary income (+71.1 billion euros) and secondary income (-47.3 billion euros). In 2017, the German current account showed a surplus of 261.2 billion euros.

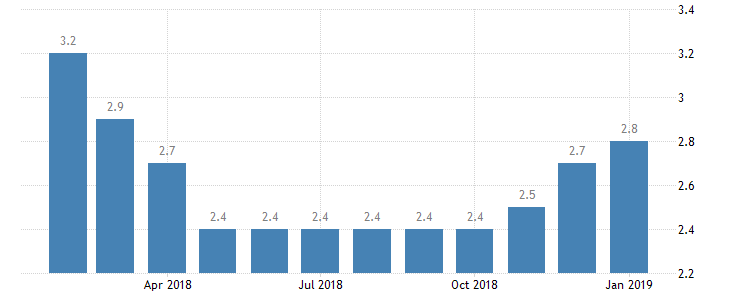

According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of January 2019, 123,962 unemployed were registered at the Regional Employment Centers (RAV), 4,301 more than in the previous month.

The unemployment rate rose from 2.7% in December 2018 to 2.8% in the month under review. Compared with the same month of the previous year, unemployment fell by 25,199 persons (-16.9%).

Youth unemployment in January 2019

Youth unemployment (aged 15-24) increased by 291 (+ 2.2%) to 13,463. Compared to the same month of the previous year, this represents a decrease of 3'082 persons (-18.6%).

Unemployed 50 and more in January 2019

The number of unemployed 50 and more increased by 1'135 persons (+ 3.4%) to 34'303. Compared to the same month of the previous year, this represents a decrease of 5,674 persons (-14.2%).

Job seekers in January 2019

A total of 200'125 jobseekers were registered, 2'175 more than in the previous month. Compared to the same period of the previous year, this number fell by 13,000 persons (-6.1%).

Estimates are in contradiction with each other

"It seems to me that we're watching the theater of the absurd"

Government program will increase GDP

Citizens' income is a "revolution", will inject money into the economy

EUR/USD

Resistance levels (open interest**, contracts)

$1.1451 (3221)

$1.1409 (1431)

$1.1386 (555)

Price at time of writing this review: $1.1338

Support levels (open interest**, contracts):

$1.1299 (2627)

$1.1250 (3009)

$1.1200 (3055)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 8 is 69805 contracts (according to data from February, 7) with the maximum number of contracts with strike price $1,1700 (4445);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3055 (1040)

$1.3016 (1953)

$1.2979 (1199)

Price at time of writing this review: $1.2944

Support levels (open interest**, contracts):

$1.2896 (537)

$1.2861 (120)

$1.2836 (341)

Comments:

- Overall open interest on the CALL options with the expiration date February, 8 is 24104 contracts, with the maximum number of contracts with strike price $1,3000 (1953);

- Overall open interest on the PUT options with the expiration date February, 8 is 25583 contracts, with the maximum number of contracts with strike price $1,2550 (1900);

- The ratio of PUT/CALL was 1.06 versus 1.06 from the previous trading day according to data from February, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 61.57 | -1.57 |

| WTI | 52.79 | -2.35 |

| Silver | 15.71 | 0.45 |

| Gold | 1309.928 | 0.28 |

| Palladium | 1382.25 | 0.64 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -122.78 | 20751.28 | -0.59 |

| ASX 200 | 66.4 | 6092.5 | 1.1 |

| FTSE 100 | -79.51 | 7093.58 | -1.11 |

| DAX | -302.7 | 11022.02 | -2.67 |

| Dow Jones | -220.77 | 25169.53 | -0.87 |

| S&P 500 | -25.56 | 2706.05 | -0.94 |

| NASDAQ Composite | -86.93 | 7288.35 | -1.18 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71025 | -0.05 |

| EURJPY | 124.511 | -0.34 |

| EURUSD | 1.13372 | -0.21 |

| GBPJPY | 142.22 | 0.03 |

| GBPUSD | 1.29504 | 0.17 |

| NZDUSD | 0.67484 | -0.39 |

| USDCAD | 1.33066 | 0.73 |

| USDCHF | 1.00233 | 0 |

| USDJPY | 109.811 | -0.14 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.