- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-05-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | April | 49.2 | 49.5 |

| 01:30 | Australia | Trade Balance | March | 4.801 | 4.25 |

| 01:30 | Australia | Retail Sales, M/M | March | 0.8% | 0.2% |

| 03:00 | New Zealand | Expected Annual Inflation 2y from now | Quarter II | 2.02% | |

| 04:30 | Australia | Announcement of the RBA decision on the discount rate | 1.5% | 1.5% | |

| 04:30 | Australia | RBA Rate Statement | |||

| 06:00 | Germany | Factory Orders s.a. (MoM) | March | -4.2% | 0.3% |

| 06:45 | France | Trade Balance, bln | March | -4 | -4.5 |

| 07:00 | Switzerland | Foreign Currency Reserves | April | 756 | |

| 07:30 | United Kingdom | Halifax house price index 3m Y/Y | April | 3.2% | 2.3% |

| 07:30 | United Kingdom | Halifax house price index | April | -1.6% | -2.4% |

| 08:00 | United Kingdom | MPC Member Cunliffe Speaks | |||

| 11:00 | U.S. | FOMC Member Kaplan Speak | |||

| 14:00 | Canada | Ivey Purchasing Managers Index | April | 54.3 | 51.1 |

| 14:00 | U.S. | JOLTs Job Openings | March | 7.087 | 7.35 |

| 15:35 | U.S. | FOMC Member Quarles Speaks | |||

| 16:30 | United Kingdom | MPC Member Andy Haldane Speaks | |||

| 19:00 | U.S. | Consumer Credit | March | 15.19 | 17 |

| 23:50 | Japan | Monetary Policy Meeting Minutes |

Major US stock indexes fell moderately, as US President Trump shocked market participants by telling Twitter on weekends that the United States would increase $ 200 billion in tariffs on imported products from China. This caused investors to flee from risky assets.

“For 10 months, China paid US duties of 25% on high-tech goods worth $ 50 billion and 10% on other goods worth $ 200 billion. These payments partly explain our remarkable economic results.” The head of the White House wrote on Twitter on Sunday. He also added: “On Friday, 10% will rise to 25%. $ 325 billion in other goods that China sends us are not taxed yet, but they will soon be at a rate of 25%, because, according to him, the negotiations between the United States and the People’s Republic of China are moving at a “too slow” pace as the Chinese side is trying to revise the conditions.

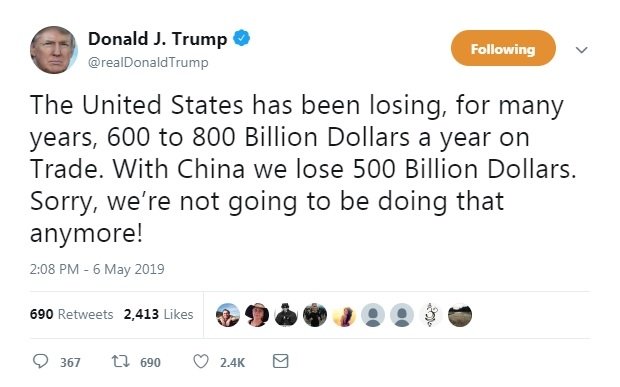

On Monday, Donald Trump continued to put pressure on Beijing on Twitter, saying: “Over the years, the United States has been losing from $ 600 to $ 800 billion a year in trade. We are losing $ 500 billion with China. Sorry, but we are no longer going to do that! ”

The Wall Street Journal reported on Sunday that the Chinese authorities are considering the possibility of canceling a new round of trade talks with the States scheduled for this week after Trump’s comments. However, official China said Monday that his delegation was still preparing to go to Washington, but did not mention whether Deputy Prime Minister Liu He, the lead negotiator from the PRC, would be in its composition as originally planned.

The US labor market data also had a slight impact on the course of trading. A report from the Conference Board showed that the US employment trends index, which is a collection of labor market indicators, improved slightly in April after registering a decline a month earlier. According to the data, the employment trends index rose to 110.79 points from 111.73 points in March (revised from 110.98). Compared to the same period in 2018, the index shows an increase of 2.3%. In the Conference Board reported that the increase in the index was caused by a positive contribution of 5 out of 8 components.

Almost all the components of DOW finished trading in the red (20 out of 30). The outsider was DowDuPont Inc. (DWDP; -3.31%). The growth leader was UnitedHealth Group Incorporated (UNH; + 3.51%).

Almost all sectors of the S & P recorded a decline. Growth was shown only by the conglomerate sector (+ 1.8%) and the health sector (+ 0.6%). The largest decline was shown by the industrial goods sector (-0.9%).

At the time of closing:

Dow 26,436.79 -68.16 -0.26%

S & P 500 2,932.47 -13.17 -0.45%

Nasdaq 100 8,123.29 -40.71 -0.50%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | April | 49.2 | 49.5 |

| 01:30 | Australia | Trade Balance | March | 4.801 | 4.25 |

| 01:30 | Australia | Retail Sales, M/M | March | 0.8% | 0.2% |

| 03:00 | New Zealand | Expected Annual Inflation 2y from now | Quarter II | 2.02% | |

| 04:30 | Australia | Announcement of the RBA decision on the discount rate | 1.5% | 1.5% | |

| 04:30 | Australia | RBA Rate Statement | |||

| 06:00 | Germany | Factory Orders s.a. (MoM) | March | -4.2% | 0.3% |

| 06:45 | France | Trade Balance, bln | March | -4 | -4.5 |

| 07:00 | Switzerland | Foreign Currency Reserves | April | 756 | |

| 07:30 | United Kingdom | Halifax house price index 3m Y/Y | April | 3.2% | 2.3% |

| 07:30 | United Kingdom | Halifax house price index | April | -1.6% | -2.4% |

| 08:00 | United Kingdom | MPC Member Cunliffe Speaks | |||

| 11:00 | U.S. | FOMC Member Kaplan Speak | |||

| 14:00 | Canada | Ivey Purchasing Managers Index | April | 54.3 | 51.1 |

| 14:00 | U.S. | JOLTs Job Openings | March | 7.087 | 7.35 |

| 15:35 | U.S. | FOMC Member Quarles Speaks | |||

| 16:30 | United Kingdom | MPC Member Andy Haldane Speaks | |||

| 19:00 | U.S. | Consumer Credit | March | 15.19 | 17 |

| 23:50 | Japan | Monetary Policy Meeting Minutes |

According to Han de Jong, the chief economist at ABN AMRO, the growth momentum in the global economy has softened for a year or so. He also thinks that the question for the remainder of the year is whether the softening continues and some economies end up in recession or not.

- The alternative route is a strengthening of growth. I am a believer in the latter view. If the economy is going to improve, we must be close to what you could call a turning point in the cycle. Around these turning points, one should expect very mixed data as some economies lead the cycle while others lag. And that is exactly what recent data shows.

- In the brave new world where China plays a key role, the eurozone is most likely still lagging, but perhaps less clearly just lagging the US. It is no surprise then that the eurozone is not showing much sign of improving momentum. The European Commission’s index for Economic Sentiment weakened again in April and fell short of not overly optimistic expectations. The data confirm that the problems are mainly in the industrial sector.

- Eurozone GDP surprised on the positive side in Q1 by growing 0.4% qoq and 1.2% yoy. We know very few details yet, but it is likely that domestic demand made the most important contribution. It is also likely that the 0.4% growth rate is flattering what is really going on, just like the US Q1 GDP growth rate of 3.2% annualized also flattered what was going on in that economy.

- The key point for me is that any fundamental improvement in economic momentum in the eurozone depends to a large extent on global economic conditions.

- Sees U.S. GDP growth a bit above 2% this year

- Sees unemployment falling to 3.5% before edging higher

- Q1 GDP was a "pleasant surprise" but possible that weakness will show up in Q2

- Says has not revised his medium-term inflation forecast

- Repeats that he sees one rate hike at most this year and possibly one more in 2020

Han de Jong, a chief economist at ABN AMRO, thinks that a significant deterioration of global trade occurred in the last couple of months of 2018 and the first months of 2019.

- The escalation of the trade conflict between the US and China and to a lesser extent between the US and other countries may have played a role. In addition, slower growth in China must have been an important driver as must have been the global IT cycle.

- I am looking for some improvement in the months ahead. There has been a clear improvement in some Chinese data. But before getting overly enthusiastic, one must bear in mind that the Chinese data are not extremely reliable and can be volatile. So you would like to see confirmation in the months ahead in the Chinese data, but also confirmation in the data of countries with strong economic ties with China.

- RRR cuts for some small- and medium-sized banks to be implemented in three phases

- Implementation in the three phases included May 15, June 17 and July 15

U.S. stock-index futures plunged on Monday after the U.S. President Donald Trump shocked investors by threatening to hike tariffs on $200 billion of Chinese goods as U.S.-China trade talks are moving "too slowly", raising fears of a global economic growth.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | - | - | - |

Hang Seng | 29,209.82 | -871.73 | -2.90% |

Shanghai | 2,906.46 | -171.87 | -5.58% |

S&P/ASX | 6,283.70 | -52.10 | -0.82% |

FTSE | |||

CAC | 5,442.64 | -106.20 | -1.91% |

DAX | 12,184.54 | -228.21 | -1.84% |

Crude oil | $61.21 | -1.18% | |

Gold | $1,278.90 | -0.19% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 182.2 | -3.02(-1.63%) | 21790 |

ALCOA INC. | AA | 26 | -0.68(-2.55%) | 19377 |

ALTRIA GROUP INC. | MO | 53.3 | -0.46(-0.86%) | 8079 |

Amazon.com Inc., NASDAQ | AMZN | 1,924.50 | -37.96(-1.93%) | 184689 |

American Express Co | AXP | 117.38 | -1.97(-1.65%) | 8434 |

AMERICAN INTERNATIONAL GROUP | AIG | 46.18 | -0.94(-1.98%) | 330 |

Apple Inc. | AAPL | 205.9 | -5.85(-2.76%) | 724824 |

AT&T Inc | T | 30.41 | -0.29(-0.94%) | 131870 |

Boeing Co | BA | 365.97 | -10.49(-2.79%) | 163754 |

Caterpillar Inc | CAT | 134.61 | -4.45(-3.20%) | 53911 |

Chevron Corp | CVX | 117.6 | 0.33(0.28%) | 67412 |

Cisco Systems Inc | CSCO | 54.04 | -0.90(-1.64%) | 39499 |

Citigroup Inc., NYSE | C | 69.18 | -1.49(-2.11%) | 27683 |

Deere & Company, NYSE | DE | 162 | -4.91(-2.94%) | 3472 |

Exxon Mobil Corp | XOM | 76.93 | -0.54(-0.70%) | 22205 |

Facebook, Inc. | FB | 191.4 | -4.07(-2.08%) | 271853 |

FedEx Corporation, NYSE | FDX | 184 | -4.06(-2.16%) | 3638 |

Ford Motor Co. | F | 10.16 | -0.25(-2.40%) | 356105 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.42 | -0.53(-4.44%) | 94162 |

General Electric Co | GE | 10.23 | -0.27(-2.57%) | 468661 |

General Motors Company, NYSE | GM | 37.72 | -1.08(-2.78%) | 21361 |

Goldman Sachs | GS | 203.76 | -3.76(-1.81%) | 9497 |

Google Inc. | GOOG | 1,169.70 | -15.70(-1.32%) | 16349 |

Hewlett-Packard Co. | HPQ | 19.93 | -0.36(-1.77%) | 8321 |

Home Depot Inc | HD | 197.3 | -3.26(-1.63%) | 10278 |

HONEYWELL INTERNATIONAL INC. | HON | 169.88 | -3.66(-2.11%) | 596 |

Intel Corp | INTC | 50.39 | -1.05(-2.03%) | 116979 |

International Business Machines Co... | IBM | 138.52 | -1.73(-1.23%) | 9124 |

International Paper Company | IP | 46.18 | -0.92(-1.95%) | 3771 |

Johnson & Johnson | JNJ | 140.52 | -1.49(-1.05%) | 4045 |

JPMorgan Chase and Co | JPM | 114 | -2.12(-1.83%) | 31762 |

McDonald's Corp | MCD | 195.25 | -2.27(-1.15%) | 9101 |

Merck & Co Inc | MRK | 78.82 | -1.18(-1.48%) | 8970 |

Microsoft Corp | MSFT | 126.85 | -2.05(-1.59%) | 195481 |

Nike | NKE | 84.39 | -1.31(-1.53%) | 11847 |

Pfizer Inc | PFE | 41.03 | -0.36(-0.87%) | 33249 |

Procter & Gamble Co | PG | 105.55 | -0.53(-0.50%) | 7838 |

Starbucks Corporation, NASDAQ | SBUX | 77.32 | -0.73(-0.94%) | 12677 |

Tesla Motors, Inc., NASDAQ | TSLA | 251.22 | -3.81(-1.49%) | 270960 |

The Coca-Cola Co | KO | 48.39 | -0.33(-0.68%) | 14211 |

Travelers Companies Inc | TRV | 141.3 | -2.05(-1.43%) | 1387 |

Twitter, Inc., NYSE | TWTR | 39.51 | -1.29(-3.16%) | 288040 |

United Technologies Corp | UTX | 139 | -2.63(-1.86%) | 7790 |

UnitedHealth Group Inc | UNH | 229 | -2.95(-1.27%) | 7834 |

Verizon Communications Inc | VZ | 56.87 | -0.37(-0.65%) | 9353 |

Visa | V | 158.66 | -3.38(-2.09%) | 41570 |

Wal-Mart Stores Inc | WMT | 101 | -1.08(-1.06%) | 20708 |

Walt Disney Co | DIS | 132.8 | -1.53(-1.14%) | 117266 |

Yandex N.V., NASDAQ | YNDX | 36.43 | -0.81(-2.18%) | 21500 |

Starbucks (SBUX) target raised to $80 from $70 at Telsey Advisory Group

Analysts at National Bank Financial think that, for the Canadian markets, April’s jobs report will draw the most attention as no less than 115K jobs were added in the country in the first three months of the year, the best performance since 2007.

- That pace is unsustainable in a context of growing labour shortages in several provinces and we suspect we’ll see a moderation in coming months, starting with a +10K print in April. The unemployment rate, meanwhile, should stay put at 5.8%, assuming the participation rate remained steady at 65.7%.

- The week will also provide some important information about the state of the housing market with the publication of March’s building permits and April’s housing starts. The latter may have bounced back to around 205K in seasonally adjusted annualized terms if, as we believe, groundbreakings for multis rose to a level more in tune with the growing number of permits granted in this category in recent months.

- We’ll also get data on March’s merchandise trade balance. Rising commodity prices during the month should have allowed nominal exports to bounce back, a development that could lead to a reduction of the trade deficit to around C$2.25 billion.

- On Monday, Bank of Canada Governor Stephen Poloz will make an address to the Canadian Credit Union Association and the Winnipeg Chamber of Commerce.

Tyson Foods (TSN) reported Q2 FY 2019 earnings of $1.20 per share (versus $1.27 in Q2 FY 2018), beating analysts’ consensus of $1.15.

The company’s quarterly revenues amounted to $10.443 bln (+6.9% y/y), beating analysts’ consensus estimate of $10.249 bln.

The company also reaffirmed guidance for FY 2019, projecting EPS of $5.75-6.10 (versus analysts’ consensus estimate of $5.95) and revenues of ~$43 bln (versus analysts’ consensus estimate of $42.46 bln).

TSN fell to $74.73 (-0.48%) in pre-market trading.

In a CNBC interview, Warren Buffett says:

- He can not gauge how U.S. and China will resolve the trade dispute

- He still believes a trade war will be "very bad" for the world

- Reaction in markets to news overnight is "rational"

Analysts at TD Securities note that the U.S. President Trump's tweets threatening to raise tariffs on $200 billion of Chinese goods hit EM assets, with equities sliding, while in FX, CNH bore the brunt of losses.

- We think Trump may be emboldened by the strength of the US economy, and firm US equities. As such the threats could amount to a negotiating ploy.

- The immediate reaction has been for China's delegation to reportedly delay or cancel its trip to Washington.

- China is not as vulnerable as it was just a few months ago. Even so, higher tariffs could put recent signs of growth stabilization under threat.

- The stakes are now clearly much higher. Failure to agree on a deal could have bigger ramifications on China and the global economy.

- After the initial bout of pressure, consolidation is likely until we see some form of clarification.

- Does not discuss the monetary policy or the economic outlook

According to analysts at Westpac, Tuesday’s RBA meeting is of key importance after Australia’s soft Q1 CPI data dramatically increased the probability of near term action by the Reserve bank of Australia (RBA).

- Market pricing for a cut in May skyrocketed to near 70% immediately following the print, thought has settled on just shy of 50% priced for the past week. Current pricing suggests a 49% likelihood of a move.

Raoul Leering, the Head of International Trade Analysis at ING, suggests that Trump's latest threats to hike import tariffs on Chinese goods is part of his risky but potentially rewarding negotiation strategy.

- President Trump added yesterday another chapter in his endless game of blowing hot and cold. In two tweets he accused China of trying to renegotiate. He threatened to hike tariffs to 25% on the $US 200 bn package of imports from China that were subject to a hike of 10% last September. Among other things China and the US still have to agree on an enforcement mechanism. The US wants to be able to punish China with renewal of tariffs if China does not live up to their side of the deal. China does, according to press statements, not accept a one-sided mechanism in which it is not allowed to retaliate tariff hike by the US.

- In our view, Trump's tweets are a negotiation strategy. In a recent speech to US Governors, Trump confirmed our longstanding interpretation of his strategy, saying that he can only secure new trade deals by imposing/threatening tariffs. Although Trump's strategy is risky, because the Chinese could refuse to negotiate at gunpoint and decide to walk out on the trade talks, both sides have invested too much political capital in the negotiations to let this happen. Trump plays hardball, but the renegotiation of NAFTA has shown that he is prepared to water down some of his toughest demands.

Analysts at TD Securities suggest that the Australian trade surplus for March is expected to shrink from the lofty $A4.8b print for February, just down to magnitude.

“March is notorious for cyclone-related stoppages for iron ore exports, while the Prelude LNG first shipment was in late March. So if the latter slips into April, expect any dip in March exports to be followed by a strong rebound in April. Also released is March and Q1 retail sales, where we look for flat monthly sales (mkt 0.2%) and 0.3% q/q for sales volumes (mkt 0.3%). Later, all eyes on the RBA OIS is 42% priced for a cut, while TD and analysts are neck and neck for a cut or pause (TD and median cut to 1.25% but by 14 vs 12). The RBA is widely expected to revise down GDP and CPI forecasts in Friday's SoMP, but the RBA Board could easily choose to pause and switch to an explicit easing bias via weak inflation, paving the way for an August cut.”

Karen Jones, analyst at Commerzbank, points out that the USD/CHF pair last week sold off to, tested and held support offered by 1.0128 (November high) and they saw two rejections from just ahead of 1.0215 at the end of last week and attention is on the downside.

“There is scope for the 55 day ma at 1.0049. This guards the 200 day ma at .9942. Above 1.0240 lies the 1.0295/January 2015 high and the 1.0343 December 2016 peak. This represents a very tough resistance band for the market – this has provoked failure for 5 years. We note the 13 count on the weekly chart and would expect the resistance to hold again. The 200 day ma guards the March low at 0.9895 and the 0.9896 6 month support line, which in turn protects the 0.9716 recent low.”

According to estimates from Eurostat, in March 2019 compared with February 2019, the seasonally adjusted volume of retail trade remained unchanged in the euro area (EA19), and increased by 0.3% in the EU28. In February 2019, the retail trade volume increased by 0.5% in both the euro area and EU28. In March 2019 compared with March 2018, the calendar adjusted retail sales index increased by 1.9% in the euro area and by 2.9% in the EU28

In the euro area in March 2019, compared with February 2019, the volume of retail trade increased by 0.6% for food, drinks and tobacco, while automotive fuel decreased by 0.6% and non-food products by 0.4%. In the EU28, the retail trade volume increased by 0.5% for food, drinks and tobacco and by 0.2% for non-food products, while automotive fuel remained stable.

In the euro area in March 2019, compared with March 2018, the volume of retail trade increased by 3.0% for nonfood products, by 1.4% for automotive fuels and by 0.7% for food, drinks and tobacco. In the EU28, the retail trade volume increased by 4.4% for non-food products, by 4.1% for automotive fuel and by 0.4% for food, drinks and tobacco.

According to the report from Sentix research group, in May, the economic situation continued to improve globally, but also in Europe. Fears of a recession are thus receding into the background, which is reflected in the improved situation values in all the regions considered.

The sentix economic index for the Euro-Zone surprises with a significant rise to 5.3 points in May. This is the third consecutive increase and the highest level since November 2018. Economists had expected an increase to 1.1 from -0.3 in April. Last improvement is supported by an increase in situation values, which rose from 3.8 to 11.0 points. The danger of recession is thus averted, even though the expected values are still just in the negative range. However, for the fourth time in a row expectations have improved to their highest level since March 2018.

The German economy also showed a strong improvement in May with a total index of 7.9. Apparently, the spark from the Chinese economy, which has recovered significantly since the start of the year, is increasingly jumping over to the export-dependent German economy. The assessment of the situation rises by almost eight points to 18.3 points. Expectations improve for the fourth time in a row to the highest level in February 2018.

According to the report from IHS Markit, the Eurozone PMI Composite Output Index recorded 51.5 in April, compared to 51.6 in the previous month. The latest index reading was the lowest for three months, though a little firmer than the flash reading of 51.3. Moreover, despite its modest level in April, by remaining above the 50.0 no-change mark, the index signalled that growth of the private sector economy has now been recorded continuously for nearly six years.

The Eurozone PMI Services Business Activity Index remained above the 50.0 no-change mark level during April, though by falling to 52.8 from 53.3 in the previous month, signalled a slightly slower rate of expansion. Economists had expected a decline to 52.5.

The moderation in growth occurred despite an improvement in growth in Germany and a return to expansion in France. Noticeably slower gains in activity were seen in Italy and Spain.

In contrast, there was a slight pick-up in growth in new business recorded during April, which continued to encourage firms to take on additional workers. Higher staffing levels meant that firms were able to keep on top of their workloads, as highlighted by data on backlogs of work which showed no change since March. Rising employment costs did, however, help to underpin another round of input cost inflation in the services economy. Although firms tried to pass on higher costs to clients, the degree of increase was slightly slower than the previous month.

U.S. President Donald Trump’s threat of increased tariffs on Chinese goods is an indication that U.S.-China trade negotiations “might have reached a sticking point,” Goldman Sachs said.

The bank said that chances of a successful deal are now lower, but suggested that an increase in tariffs could still be avoided — especially if the Chinese delegation still attends its meeting with U.S. negotiators this week.

Referring to Trump’s latest gambit, Goldman economists said: “This represents a shift from the optimistic statements from US officials over the last few weeks and suggests that the probability of a near-term agreement is at least slightly lower than it seemed to be recently.”

Yet Goldman said it believes an agreement could still be reached, adding that it is still “slightly” more likely to happen than an increase in duties. It put the odds of a tariff escalation by the end of the week at 40% currently.

According to analysts at ANZ, the wait will soon be over for the much anticipated May Monetary Policy Statement of RBNZ, which is out at 2pm on Wednesday.

“Since the RBNZ’s dovish shift in guidance at the March OCR review, market pricing has been quite appropriately ebbing and flowing around the 50% mark for a cut in May. More analysts than not are now calling a May cut, but we’re not among them. On balance we expect the Bank to deliver a dovish hold, presenting a downward-sloping OCR track and firming up its language around the likely impending need for additional monetary stimulus. By August, we think the evidence that slowing economic momentum and waning capacity pressures will be sufficiently strong for the RBNZ to cut the OCR, but we certainly wouldn’t rule out that they’ll decide to bite the bullet next week. It’s a nail-biter. There’s also three ANZ proprietary indicators and another GlobalDairyTrade auction out this week.”

South China Morning Post, citing an unnamed source briefed on the latest plans, reported on Monday that China Vice Premier Liu He could still travel to the United States for trade negotiations but shorten his trip or cancel it altogether,

In an earlier version of the report, the newspaper said Liu would go to the United States, albeit for a shorter that previously planned length of time. In its latest report, the SCMP said Liu could travel to Washington on Thursday and then leave the following day.

The report follows comments by U.S. President Trump that he would hike U.S. tariffs on $200 billion worth of Chinese goods this week.

According to Danske Bank analysts, we have a very interesting week ahead of us although today is quiet in terms of economic data releases.

“We thought that the US and China were about to strike a trade deal this week, but Trump's latest tweet questions that. This is likely to dominate markets today. In terms of economic data releases, European PMI services, retail sales and investor confidence are due out today. In the UK, we will follow the cross-party negotiations between Theresa May and Jeremy Corbyn that May's team wants to wrap up this week after both parties suffered in the UK elections last week. According to media reports, Theresa May is preparing to offer Corbyn to make a customs arrangement with the EU. Otherwise this week, German industrial production, US inflation and China inflation are due out. The EU Commission is also publishing its new economic forecasts for the EU countries.”

China's central bank said on Monday it will cut reserve requirement ratios (RRRs) to release about 280 billion yuan for some small and medium-sized banks, in a targeted move to support companies struggling amid an economic slowdown.

The amount of cash released by the latest cut would be one of the smallest from any of the RRR cuts since January 2018.

The People's Bank of China (PBOC) said in a statement that the reduction will come into effect on May 15. The funds will be used for loans to small and private companies.

The central bank said it will cut the RRR for about 1,000 rural commercial banks operating in counties to 8 percent, equal to the RRR for smaller rural credit cooperatives.

The move will help lower funding costs for small and micro firms, the PBOC said. Small and medium-sized banks currently have RRRs ranging from 10 percent to 11.5 percent.

President Donald Trump dramatically increased pressure on China on Sunday to reach a trade deal, saying he would hike U.S. tariffs on $200 billion worth of Chinese goods this week and target hundreds of billions more soon.

The move marked a major escalation in tensions between the world's largest economies and a shift in tone from Trump, who had cited progress in trade talks as recently as Friday.

"The Trade Deal with China continues, but too slowly, as they attempt to renegotiate. No!" Trump said in a tweet.

Trump said tariffs on $200 billion of goods would increase to 25 percent on Friday from 10 percent, reversing a decision he made in February to keep them at the 10 percent rate thanks to progress between the two sides.

The president also said he would target a further $325 billion of Chinese goods with 25 percent tariffs "shortly," essentially covering all products imported to the United States from China.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1341 (4518)

$1.1312 (2133)

$1.1272 (228)

Price at time of writing this review: $1.1189

Support levels (open interest**, contracts):

$1.1146 (8220)

$1.1113 (4987)

$1.1075 (4537)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 7 is 107646 contracts (according to data from May, 3) with the maximum number of contracts with strike price $1,1200 (8220);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3322 (2011)

$1.3276 (1783)

$1.3244 (809)

Price at time of writing this review: $1.3117

Support levels (open interest**, contracts):

$1.3046 (412)

$1.3016 (1851)

$1.2984 (1769)

Comments:

- Overall open interest on the CALL options with the expiration date June, 7 is 36151 contracts, with the maximum number of contracts with strike price $1,3450 (3079);

- Overall open interest on the PUT options with the expiration date June, 7 is 35472 contracts, with the maximum number of contracts with strike price $1,2800 (3303);

- The ratio of PUT/CALL was 0.98 versus 1.13 from the previous trading day according to data from May, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 70.54 | 0.53 |

| WTI | 61.86 | 0.49 |

| Silver | 14.9 | 2.05 |

| Gold | 1278.94 | 0.67 |

| Palladium | 1366.44 | 0.92 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| Hang Seng | 137.37 | 30081.55 | 0.46 |

| KOSPI | -16.43 | 2196.32 | -0.74 |

| ASX 200 | -2.6 | 6335.8 | -0.04 |

| FTSE 100 | 29.33 | 7380.64 | 0.4 |

| DAX | 67.33 | 12412.75 | 0.55 |

| CAC 40 | 9.98 | 5548.84 | 0.18 |

| Dow Jones | 197.16 | 26504.95 | 0.75 |

| S&P 500 | 28.12 | 2945.64 | 0.96 |

| NASDAQ Composite | 127.23 | 8164 | 1.58 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.70224 | 0.34 |

| EURJPY | 124.446 | -0.12 |

| EURUSD | 1.12008 | 0.26 |

| GBPJPY | 146.333 | 0.72 |

| GBPUSD | 1.31713 | 1.09 |

| NZDUSD | 0.66421 | 0.39 |

| USDCAD | 1.34194 | -0.38 |

| USDCHF | 1.01634 | -0.26 |

| USDJPY | 111.079 | -0.38 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.