- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-02-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | U.S. | Fed Chair Powell Speaks | |||

| 05:00 | Japan | Leading Economic Index | December | 99.1 | 97.9 |

| 05:00 | Japan | Coincident Index | December | 102.9 | |

| 07:00 | Germany | Industrial Production s.a. (MoM) | December | -1.9% | 0.8% |

| 07:45 | France | Trade Balance, bln | December | -5.1 | -4 |

| 08:00 | Switzerland | Foreign Currency Reserves | January | 729 | |

| 08:30 | United Kingdom | Halifax house price index 3m Y/Y | January | 1.3% | 1.5% |

| 08:30 | United Kingdom | Halifax house price index | January | 2.2% | -0.5% |

| 09:00 | Eurozone | ECB Economic Bulletin | |||

| 10:00 | Eurozone | EU Economic Forecasts | |||

| 12:00 | United Kingdom | BoE Interest Rate Decision | 0.75% | 0.75% | |

| 12:00 | United Kingdom | Bank of England Minutes | |||

| 12:00 | United Kingdom | Asset Purchase Facility | 435 | 435 | |

| 12:00 | United Kingdom | BOE Inflation Letter | |||

| 12:15 | Eurozone | ECB's Yves Mersch Speaks | |||

| 13:30 | U.S. | Continuing Jobless Claims | 1782 | 1720 | |

| 13:30 | U.S. | Initial Jobless Claims | 253 | 220 | |

| 14:30 | U.S. | FOMC Member Clarida Speaks | |||

| 20:00 | U.S. | Consumer Credit | December | 22.2 | 17 |

| 23:30 | Japan | Household spending Y/Y | December | -0.6% | 0.8% |

| 23:50 | Japan | Current Account, bln | December | 757.2 | 429.8 |

Major US stock indices fell slightly, as investors analyzed the mixed quarterly results of the corporate segment, as well as the report of the US President to Congress on the situation in the country.

In his report, Donald Trump mentioned issues such as infrastructure costs, drug prices and trade. He also raised the issue of financing the border wall along the border of the United States and Mexico. Trump reaffirmed his conviction that the United States needed a wall, but did not declare a state of emergency, as he had previously threatened to do. Thus, the president has softened his tone around the financing of the wall on the border with Mexico, but this does not exclude the possibility that the federal government may again suspend work if its demand for financing its construction is not met.

The president also said that China and the United States are working on a new trade deal, but noted that it should “include real structural changes to put an end to unfair trade practices, reduce our chronic trade deficit, and protect American jobs.”

The focus of market participants was also the report of the Ministry of Commerce, which showed that the US trade balance deficit sharply declined in November amid a decline in imports of mobile phones and petroleum products. According to the report, the trade deficit fell in November by 11.5% to $ 49.3 billion. The data for October were revised - $ 55.5 billion by - $ 55.7 billion. Economists had forecast a trade deficit of $ 54.0 billion.

Most of the components of DOW finished trading in positive territory (16 of 30). The growth leader was UnitedHealth Group (UNH, + 1.16%). The outsider was DowDuPont Inc. (DWDP, -1.81%).

Most sectors of the S & P recorded a decline. The largest decline was shown by the base materials sector (-0.7%), the largest growth was by the conglomerates sector (+ 0.3%).

At the time of closing:

Dow 25,389.90 -21.62 -0.09%

S & P 500 2,731.62 -6.08 -0.22%

Nasdaq 100 7,375.28 -26.80 -0.36%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | U.S. | Fed Chair Powell Speaks | |||

| 05:00 | Japan | Leading Economic Index | December | 99.1 | 97.9 |

| 05:00 | Japan | Coincident Index | December | 102.9 | |

| 07:00 | Germany | Industrial Production s.a. (MoM) | December | -1.9% | 0.8% |

| 07:45 | France | Trade Balance, bln | December | -5.1 | -4 |

| 08:00 | Switzerland | Foreign Currency Reserves | January | 729 | |

| 08:30 | United Kingdom | Halifax house price index 3m Y/Y | January | 1.3% | 1.5% |

| 08:30 | United Kingdom | Halifax house price index | January | 2.2% | -0.5% |

| 09:00 | Eurozone | ECB Economic Bulletin | |||

| 10:00 | Eurozone | EU Economic Forecasts | |||

| 12:00 | United Kingdom | BoE Interest Rate Decision | 0.75% | 0.75% | |

| 12:00 | United Kingdom | Bank of England Minutes | |||

| 12:00 | United Kingdom | Asset Purchase Facility | 435 | 435 | |

| 12:00 | United Kingdom | BOE Inflation Letter | |||

| 12:15 | Eurozone | ECB's Yves Mersch Speaks | |||

| 13:30 | U.S. | Continuing Jobless Claims | 1782 | 1720 | |

| 13:30 | U.S. | Initial Jobless Claims | 253 | 220 | |

| 14:30 | U.S. | FOMC Member Clarida Speaks | |||

| 20:00 | U.S. | Consumer Credit | December | 22.2 | 17 |

| 23:30 | Japan | Household spending Y/Y | December | -0.6% | 0.8% |

| 23:50 | Japan | Current Account, bln | December | 757.2 | 429.8 |

The U.S. Energy Information Administration (EIA) revealed that crude inventories rose by 1.263 million barrels in the week ended February 1. Economists had forecast an increase of 1.850 million barrels.

At the same time, gasoline stocks rose by 0.513 million barrels, while analysts had expected a build of 1.500 million barrels. Distillate stocks fell by 2.257 million barrels, while analysts had forecast a decrease of 2.000 million barrels.

Meanwhile, oil production in the U.S. was unchanged at 11.900 million barrels per day.

U.S. crude oil imports averaged 7.1 million barrels per day last week, down by 1,108,000 barrels per day from the previous week.

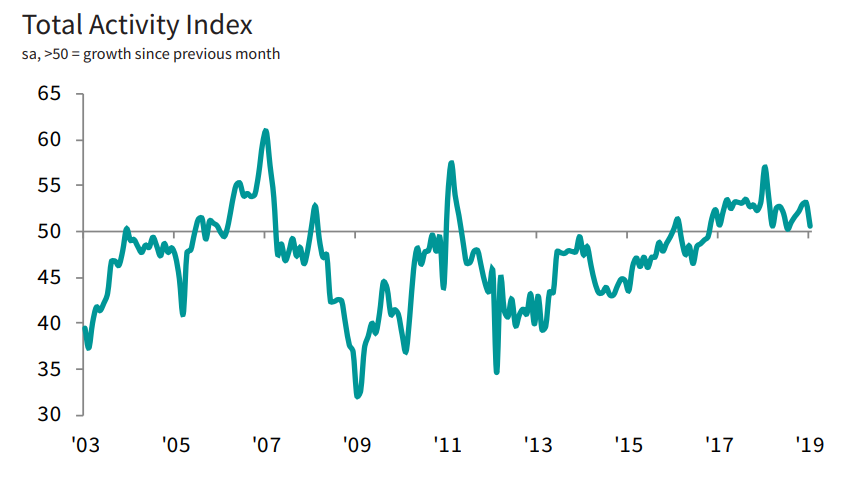

The Ivey Business School Purchasing Managers Index (PMI), measuring Canada’s economic activity, fell to 54.7 in January 2019 from an unrevised 59.7 December 2018.

Economists had expected the gauge to hit 56.0.

A figure above 50 shows an increase while below 50 shows a decrease.

Within sub-indexes, the prices index dropped to 57.4 last month from 64.6 in December, while the employment measure declined to 51.8 from 54.0 and the supplier deliveries gauge decreased to 41.7 from 43.3. At the same time, the inventories indicator rose to 53.6 in January from 52.5 in the prior month.

U.S. stock-index were flat on Wednesday after President Donald Trump at his State of the Union speech raised the prospect of another shutdown should his demand for border wall funding not be met. Meanwhile, a raft of upbeat corporate earnings and trade balance data supported the market sentiment.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,874.06 | +29.61 | +0.14% |

Hang Seng | - | - | - |

Shanghai | - | - | - |

S&P/ASX | 6,026.10 | +20.20 | +0.34% |

FTSE | 7,163.24 | -14.13 | -0.20% |

CAC | 5,075.18 | -8.16 | -0.16% |

DAX | 11,325.81 | -42.17 | -0.37% |

Crude | $53.57 | -0.17% | |

Gold | $1,317.70 | -0.11% |

The U.S. Commerce Department reported the U.S. the goods and services trade deficit narrowed by 11.5 percent m-o-m (or $6.4 billion) to $49.31 billion in November from a revised $55.70 billion in October (originally a gap of $55.49 billion).

Economists had expected a deficit of $54 billion.

According to the report, the November decrease in the goods and services deficit reflected a drop in the goods deficit of 8.5 percent m-o-m (or $6.67 billion) to $71.59 billion, while services surplus reduced marginally (-1.3 percent m-o-m to $22.28 billion).

November exports were $209.87 billion, down 0.6 percent m-o-m, while November imports stood at $259.19 billion, down 2.9 percent m-o-m.

Year-to-date, the goods and services deficit surged 10.4 percent y-o-y (or $51.88 billion). Exports rose 7.3 percent y-o-y, while imports boosted 7.9 percent y-o-y.

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 201.5 | 0.38(0.19%) | 570 |

ALCOA INC. | AA | 28.93 | -0.14(-0.48%) | 401 |

ALTRIA GROUP INC. | MO | 49 | -0.04(-0.08%) | 84754 |

Amazon.com Inc., NASDAQ | AMZN | 1,671.50 | 12.69(0.77%) | 49178 |

Apple Inc. | AAPL | 174.85 | 0.67(0.38%) | 162635 |

AT&T Inc | T | 29.7 | 0.07(0.24%) | 14775 |

Boeing Co | BA | 414.79 | 4.61(1.12%) | 48367 |

Caterpillar Inc | CAT | 131.55 | -0.45(-0.34%) | 3628 |

Cisco Systems Inc | CSCO | 47.16 | -0.10(-0.21%) | 277766 |

Citigroup Inc., NYSE | C | 63.77 | -0.04(-0.06%) | 53042 |

Exxon Mobil Corp | XOM | 75.51 | -0.08(-0.11%) | 6160 |

Facebook, Inc. | FB | 171.3 | 0.14(0.08%) | 78724 |

FedEx Corporation, NYSE | FDX | 183.24 | -0.49(-0.27%) | 610 |

Ford Motor Co. | F | 8.8 | 0.05(0.57%) | 225736 |

General Electric Co | GE | 10.68 | 0.05(0.47%) | 323744 |

General Motors Company, NYSE | GM | 40.77 | 1.47(3.74%) | 466062 |

Google Inc. | GOOG | 1,146.48 | 0.49(0.04%) | 4377 |

Intel Corp | INTC | 49.99 | 0.30(0.59%) | 50954 |

International Business Machines Co... | IBM | 135.89 | 0.34(0.25%) | 1233 |

Johnson & Johnson | JNJ | 132.4 | -0.48(-0.36%) | 47197 |

Merck & Co Inc | MRK | 77.12 | -0.03(-0.04%) | 13686 |

Microsoft Corp | MSFT | 106.96 | -0.26(-0.24%) | 64412 |

Nike | NKE | 82.66 | -0.20(-0.24%) | 945 |

Pfizer Inc | PFE | 42.04 | -0.07(-0.17%) | 71776 |

Procter & Gamble Co | PG | 97.32 | -0.12(-0.12%) | 1159 |

Starbucks Corporation, NASDAQ | SBUX | 69.15 | 0.17(0.25%) | 3044 |

Tesla Motors, Inc., NASDAQ | TSLA | 319.25 | -2.10(-0.65%) | 48895 |

The Coca-Cola Co | KO | 49 | -0.26(-0.53%) | 1724 |

Twitter, Inc., NYSE | TWTR | 35.08 | 0.71(2.07%) | 222937 |

Verizon Communications Inc | VZ | 54.25 | 0.11(0.20%) | 2621 |

Visa | V | 142.38 | -0.15(-0.11%) | 4187 |

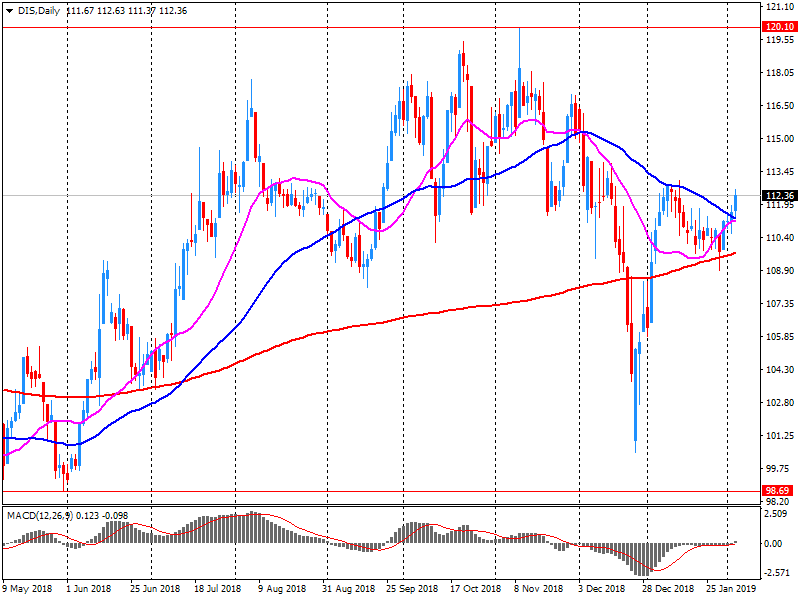

Walt Disney Co | DIS | 113.65 | 0.99(0.88%) | 98327 |

Yandex N.V., NASDAQ | YNDX | 34.14 | -0.28(-0.81%) | 12172 |

DowDuPont (DWDP) downgraded from Outperform to Market Perform at Cowen

Statistics Canada reported that the value of building permits issued by the Canadian municipalities rose 6% percent m-o-m in December, following a revised 2.1 percent m-o-m gain in November (originally a 2.6 percent m-o-m increase).

Economists had forecast a 1.0 percent decline in December from the previous month.

According to the report, the value of residential permits grew by 4.2 percent m-o-m as building permits for multi-family dwellings surged 11.1 percent m-o-m, more than paring a 5.4 percent m-o-m drop in the single-family dwelling component.

Meanwhile, non-residential building permits climbed by 8.9 percent m-o-m in December, boosted by gains in industrial (+11.9 percent m-o-m) and commercial (+14.6 percent m-o-m) components. In contrast, the value of institutional permits fell 10.6 percent m-o-m, recording the third consecutive monthly decrease.

In y-o-y terms, building permits increased by 10.6 percent in December.

For the full 2018, building permits rose 4.7 percent, recording the fifth consecutive annual increase. Higher construction intentions for multi-family dwellings and commercial buildings were the main factors behind the advance.

The U.S. Treasury secretary Steven Mnuchin said that trade talks are "very productive" so far. He also confirmed he's headed to Beijing next week.

Mnuchin spoke on CNBC's "Squawk Box" Wednesday morning.

European Council President Donald Tusk has blasted British politicians who lobbied for the U.K. to exit the European Union (EU) without first working out how to do it.

Tusk stated: “I have been wondering what a special place in hell looks like for those who promoted Brexit without even a sketch of plan how to carry it safely.”

Tusk also gave no indication that the other 27 EU countries will be up for reopening the Brexit withdrawal agreement that the UK's Prime Minister Theresa May negotiated but which was overwhelmingly rejected by British parliamentarians.

Speaking alongside Irish Prime Minister Leo Varadkar, Tusk said: “the EU 27 is not making any new offer” to the British government to help pass their Brexit divorce deal in the UK parliament.

Walt Disney (DIS) reported Q4 FY 2018 earnings of $1.84 per share (versus $1.89 in Q4 FY 2017), beating analysts’ consensus estimate of $1.57.

The company’s quarterly revenues amounted to $15.303 bln (-0.3% y/y), generally in line with analysts’ consensus estimate of $15.203 bln.

DIS rose to $113.35 (+0.61%) in pre-market trading.

The Telegraph reported the UK's Prime Minister Theresa May will seek a Brexit breakthrough when she meets with the DUP on Wednesday after saying the backstop would not be removed from her Withdrawal Agreement.

According to the report, May's meeting with Arlene Foster, the DUP leader, will be closely scrutinized given the PM is reliant on the party’s 10 MPs to command a majority in the House of Commons.

Ms. Foster has said her party would support Mrs. May’s deal if the backstop issue can be resolved but is yet to say exactly which solution to the problem she would favor.

The meeting of the pair will come as Leo Varadkar, the Irish Taoiseach, visits Brussels for meetings with Jean-Claude Juncker, the European Commission president, and Donald Tusk, the European Council president.

Mr. Varadkar is expected to seek guarantees of support from the EU to mitigate the impact of a potential no-deal Brexit on Ireland.

The chief Brexit representative for the European Parliament, Guy Verhofstadt, tweeted:

"Today I see Taoiseach Leo Varadkar and tomorrow Prime Minister May. My message to the UK will be that it is not very responsible to try to get rid of a backstop that is meant as an ultimate safeguard to avoid a hard border and the return of violence on the Island of Ireland."

The Ifo Institute in Munich hasIfolculated how the United Kingdom can keep the negative economic consequences of a hard Brexit as small as possible: by unilaterally waiving all import duties after March 29.

"That would be a very smart trick for the British government," says Gabriel Felbermayr, head of the ifo Center for International Economics. "Without British import duties, consumption in the Kingdom would fall by only 0.5 percent, much less than with a hard Brexit with import duties a la World Trade Organization (WTO). This would shrink consumption by 2.8 percent. With comprehensive free trade agreements with many countries a la Global Britain, consumption would still fall by 1.4 percent."

"In the case of food in particular, WTO tariffs would lead to extreme price effects, presumably in the order of 12 to 15 percent, similar to those for cars, textiles and shoes," Felbermayr continues. "It is questionable whether this is so favourable for the British government from a domestic political point of view.“ In any case, the question is whether Great Britain is at all technically capable of implementing comprehensive customs controls on its high imports.

The report mainly highlights that negotiations between the two parties are seen as an act of 'political theater', with both sides seemingly to have insurmountable obstacles which would seem to 'kill off trade talks' even before they have begun.

He suggests it could in fact be as soon as next Friday for those exporting to places like Japan who need certainty about the tariffs they will face.

The U.S. Federal Reserve will likely raise rate at least twice in 2019 against a backdrop of continued economic strength as opposed to "misguided" market assumptions of no hikes this year, according to Franklin Templeton's head of bonds.

"I would still anticipate that it will deliver at least two more rate hikes this year. I believe that the market’s assumption that the Fed will not raise interest rates at all this year is very misguided, against a background of continued economic strength," said Sonal Desai, chief investment officer for the Fixed Income Group at Franklin Templeton.

According to the report from Mechanical Engineering Industry Association (VDMA), in December 2018, incoming orders in the German mechanical engineering sector fell short of the previous year's level by 8%.

“The 10% decline in Germany was particularly disappointing," said VDMA economic expert Olaf Wortmann.

"The 8% drop in foreign orders, on the other hand, can be put into perspective. In December 2017, there were more large installations business from the non-euro area than at the end of last year," he explained. It is pleasing to note that orders from the euro partner countries increased by 22% year-on-year in December. By contrast, 17% fewer orders came from non-euro countries.

"It is pleasing to note that orders from the euro partner countries increased by 22% year-on-year in December."

In 2018 as a whole, machine builders recorded a 6% increase in domestic orders, while orders from abroad rose by 4%.

The French government is too optimistic about the outlook for its public finances this year, overestimating growth and planned budget savings, France's public audit office said.

President Macron's government lifted its 2019 public deficit target in December to 3.2% of economic output, overshooting the European Union's 3-percent limit. It raised the target after Macron announced an 11 billion euro (?9.7 billion) package of concessions to anti-government protestors who had led some of the worst street violence in Paris since the 1968 student demos.

The audit office said that the deficit target was built on an outdated growth forecast of 1.7% which did not take into account recent weak economic data. It said the growth outlook also failed to reflect the impact of increased savings the government is hoping to come up with to offset the cost of the concessions package.

The audit office urged the government to revise its growth outlook "as soon as possible" and said that spending cuts needed to be stepped up in order to push ahead with planned tax cuts.

According to the latest PMI data from IHS Markit, German construction activity continued to rise in January, though severe bad weather in parts of the country saw the rate of expansion slow compared with the relatively mild December.

The headline seasonally adjusted Germany Construction PMI – a measure of changes in total industry activity – slip to 50.7, down from 53.3 in December and its lowest reading in the current three-month sequence of growth

New order growth was robust but also eased, as did the rates of increase in employment and constructors' buying levels. Despite the slowdown, constructors remained confident about the prospect of activity rising in the next 12 months. On the cost front, constructors faced steep and accelerated rises in both sub-contractor rates and average purchase prices, with the latter reportedly driven up by increased energy costs and road toll charges.

January data from IHS Markit pointed to the softest increase in eurozone construction activity since July 2018. The slowdown was partly driven by activity declines in two of the three monitored subsectors and only a moderate rise in new business. Weaker demand for building work also saw the rate of job creation ease to a near-two-year low and purchasing activity rise at its slowest pace since last October. Despite this, construction firms were the most optimistic towards the business outlook for six months.

Falling from 53.1 in December to 50.6 in January, the IHS Markit Eurozone Construction PMI signalled the slowest rise in construction activity for six months. The rate of growth eased in both Germany and Italy, while French constructors reported the first contraction for five months.

Eliot Kerr, Economist at IHS Markit, which compiles the survey, said: “The eurozone construction sector got off to a sluggish start in 2019, posting its softest activity expansion for six months during January. This was mainly driven by a marginal contraction in France, but there was also slower growth in Germany and Italy”.

Senior U.S. and Chinese officials are poised to start another round of trade talks in Beijing next week to push for a deal to protect American intellectual property and avert a March 2 increase in U.S. tariffs on Chinese goods, two people familiar with the plans said.

The sources said that the U.S. delegation - led by U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin - would begin arriving in Beijing over the weekend, following a break this week for Chinese New Year.

А leading think-tank said on Wednesday, british finance minister Philip Hammond will probably say next month that he will miss a key budget target because he will not be able to squeeze spending as much as he planned.

Hammond says he wants to hold the underlying budget deficit below 2 percent of the country's economic output in the 2020/21 financial year. But he is also under pressure to ease the strain on hospitals and other public services, while some welfare reforms are on hold due to their impact on poorer households.

The National Institute of Economic and Social Research said Hammond would probably have to relax his target or drop it when he makes a half-yearly budget statement on March 13. But even that gentler squeeze on spending would probably be too hard to achieve, NIESR said.

NIESR cut its forecast for British economic growth in 2019 to 1.5 percent from a previous estimate of 1.9 percent, citing a slowdown in the economy at home and globally.

European Central Bank officials see no urgent need to offer new long-term loans to banks and aren’t certain to do so at their next policy meeting in March, according to people familiar with the matter.

Officials aren’t yet convinced about the necessity for more liquidity and are nervous that an offering could fuel perceptions that they’re helping out particular lenders, said the people on condition of anonymity..

Most economists expect the ECB to announce a watered-down version of the last TLTRO program -- possibly similar to previous rounds of long-term funding that had shorter maturities and less attractive borrowing conditions.

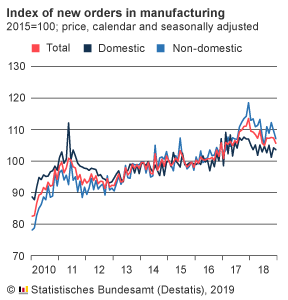

According to the report from Destatis, price-adjusted new orders in manufacturing had decreased in December 2018 a seasonally and calendar adjusted 1.6% on the previous month. Economists had expected a 0.3% increase.

For November 2018, major orders were reported subsequently. Revision of the preliminary data resulted in a decrease of 0.2% for November 2018 compared to October 2018 (primary: -1.0%). Price-adjusted new orders without major orders in manufacturing had increased in December 2018 a seasonally and calendar adjusted 3.5% on the previous month.

Domestic orders decreased by 0.6% and foreign orders fell by 2.3% in December 2018 on the previous month. New orders from the euro area were up 3.2%, new orders from other countries decreased 5.5% compared to November 2018.

In December 2018 the manufacturers of intermediate goods saw new orders fall by 1.2% compared with November 2018. The manufacturers of capital goods showed decreases of 2.5% on the previous month. For consumer goods, an increase in new orders of 4.2% was recorded.

new trade deal with China must include end unfair trade practices, reduce our chronic trade deficit, and protect american jobs

Trump says he is eager to work with congress on infrastructure investment legislation

Trump says his budget will include request for funding to defeat aids within 10 years

only thing that can stop strong u.s. economy is "foolish wars, politics, or ridiculous partisan investigations"

Senate has failed to approve 300 nominees which is "unfair to the nominees and to our country"

Administration has sent to congress a "commonsense proposal" that includes plans for a "new physical barrier, or wall" on southern border

lower rates might be appropriate if unemployment rises, inflation stalls

probabilities on next rate move "appear to be more evenly balanced"

there are scenarios where the next move in rates is up, others where it is down

board does not see strong case for a near-term change in cash rate

will be monitoring developments in labour market closely

if jobs and wages rising, will be appropriate to raise cash rate at some stage

lower rates might be appropriate if unemployment rises, inflation stalls

in position to maintain current policy while assessing shifts in global economy, household spending

downside risks to domestic economy have increased

household consumption expected to grow around 2.75 pct over next couple of years

still expect economy to grow at reasonable pace over next couple of years

sees economy expanding by around 3 pct in 2019, 2.75 pct over 2020

expects Q4 GDP to be stronger than surprisingly soft Q3 outcome

unemployment declining to around 4.75 pct over the next two years

underlying inflation to rise to about 2 pct later this year, 2.25 pct by end of 2020

expect consumer inflation to gradually accelerate toward 2 pct

Japan's economy has improved significantly since 2013

expansion of base money has impact on economy via decline in real interest rates, which pushes down bank lending rates

huge expansion of monetary base in itself won't immediately stimulate economy

EUR/USD

Resistance levels (open interest**, contracts)

$1.1508 (3828 )

$1.1475 (3136)

$1.1457 (577)

Price at time of writing this review: $1.1394

Support levels (open interest**, contracts):

$1.1347 (4051)

$1.1299 (2768)

$1.1250 (3055)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 8 is 70305 contracts (according to data from February, 5) with the maximum number of contracts with strike price $1,1700 (4445);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3039 (1942)

$1.3017 (559)

$1.2989 (1205)

Price at time of writing this review: $1.2948

Support levels (open interest**, contracts):

$1.2916 (276)

$1.2880 (462)

$1.2839 (526)

Comments:

- Overall open interest on the CALL options with the expiration date February, 8 is 24090 contracts, with the maximum number of contracts with strike price $1,3000 (1942);

- Overall open interest on the PUT options with the expiration date February, 8 is 25317 contracts, with the maximum number of contracts with strike price $1,2550 (1900);

- The ratio of PUT/CALL was 1.05 versus 1.03 from the previous trading day according to data from February, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 61.99 | -1.1 |

| WTI | 53.95 | -1.78 |

| Silver | 15.82 | -0.13 |

| Gold | 1314.808 | 0.22 |

| Palladium | 1379.34 | 1.08 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -39.32 | 20844.45 | -0.19 |

| ASX 200 | 114.7 | 6005.9 | 1.95 |

| FTSE 100 | 143.24 | 7177.37 | 2.04 |

| DAX | 191.4 | 11367.98 | 1.71 |

| Dow Jones | 172.15 | 25411.52 | 0.68 |

| S&P 500 | 12.83 | 2737.7 | 0.47 |

| NASDAQ Composite | 54.54 | 7402.08 | 0.74 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.72341 | 0.13 |

| EURJPY | 125.394 | -0.21 |

| EURUSD | 1.14035 | -0.28 |

| GBPJPY | 142.399 | -0.6 |

| GBPUSD | 1.29499 | -0.67 |

| NZDUSD | 0.68923 | 0.13 |

| USDCAD | 1.31257 | 0.12 |

| USDCHF | 0.99985 | 0.21 |

| USDJPY | 109.957 | 0.06 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.